Benefit-Cost Analysis

The economic factors of this project include Lafayette’s current financial standing, the availability of external funding, and the actual cost of the alternatives in question. Before determining the best way to fund the project, we organized which projects are worth the investment. A cost-benefit analysis is one of the standard methods of deciding which option might be ideal. For this analysis, we will consider the do-nothing option, in addition to a general reforestation alternative, and a general organic farming alternative. Aspects that are important to consider are direct costs from implementing and maintaining the choice, as well as the indirect impacts, such as the social cost of carbon. Defining the social cost of carbon is “an estimate, in dollars, of the economic damages that would result from emitting one additional ton of greenhouse gases into the atmosphere” (Rennert and Kingdon, 2019). Comparing both the financial and social costs and benefits permits Lafayette to determine the alternatives that are currently ideal.

In general, there are numerous benefits associated with carbon storage options, any action to combat climate change is a benefit as it acts as additional protection to threats such as extreme weather events or negative health impacts. However, as with any technology, there are risks and other costs involved. For example, when increasing plant life, an area becomes more susceptible to wildfire, pests, and disease (Climate Action Benefits, 2015). According to the EPA, “The economic value of these changes in carbon storage range from $9 billion in dis-benefits to $120 billion in GHG mitigation benefits (both discounted at 3%)” (Climate Action Benefits, 2015). To conduct a complete cost-benefit analysis for Lafayette College’s alternatives, it will require a more in-depth understanding of the land and how it will be maintained. Due to the variance in numbers associated with carbon capture techniques, we focused our calculations on each option’s effectiveness in capturing carbon.

As stated previously, according to Lafayette College’ s CAP, in 2017, Lafayette College emitted 24,092 MTCO2e or 53,113,768 lbs (2019 Climate Action Plan, 2019). Acting under the assumption that there have not been significant fluctuations in this number, it was used as a baseline to compare the storage capabilities of the reforestation alternative and organic farming alternative. Since nothing changes in the do-nothing alternative, we assumed that its net change is equal to zero, neither causing an increase or decrease in the number of emissions stored.

For the organic farming alternative, we considered only the effects of implementing cover crop technology on the three-acre area of LaFarm. According to the IPCC report, cover crops have the capability of increasing “soil carbon stock by between 0.22 and 0.4 t ha-1 yr-1 ” (IPCC, 2019, 4-60). The calculated average of 0.31tC/ha/yr was the value used. By converting the units of area for LaFarm from acres to hectares (0.4047 ha:1acre), and multiplying it by the carbon stock factor, we found that the annual increase in carbon stock is approximately 0.3764 tC/yr.

We followed a similar process for the reforestation alternative, first converting the units of the total area available for trees (125 acres) into hectares. Based on an article published in Issues in Environmental Science and Technology, “Yields of carbon for permanent afforestation are of the order of 1 MgC ha-1yr-1” (Lenton, 2014, 57). Since 1 MgC ha-1yr-1 is equivalent to 1 tC/ha/yr, we multiplied the factor of carbon stored in metric tones by the area available to get an annual storage rate of approximately 50.5875 tC/yr. Just based on these numbers, one would assume that implementing a single alternative is not enough to achieve carbon neutrality at Lafayette College. However, this comparison shows that any option has an impact, and by combining reforestation with other, smaller-impact alternatives, they can play an influential role in reducing the school’s emissions.

Modeling Carbon Capture at Metzgar

Lafayette College currently has 69 buildings on campus. In total, these buildings are approximately 1.76 million square feet. The total campus size is 340 acres and includes the roughly 210 acre Metzgar fields. Metzgar field is composed of 125-acre farmland, an 80-acre athletic complex, and 3-acres being LaFarm. Although Metzgar Field accounts for a large portion of the colleges’ total acreage, the athletic campus has two buildings that are significantly smaller than most of the buildings on campus. Metzgar athletic field is part of an 80-acre facility that also contains fields for many of the intramural and recreational sports programs. There are two buildings on this property. The main building and central point of the Metzgar Campus are the Kamine Varsity House. This building contains locker rooms for baseball, field hockey, men’s lacrosse, women’s lacrosse, men’s soccer, women’s soccer, men’s cross country/track & field, women’s cross country/track & field and softball. Each locker room is similar and all have flat-panel video monitors as well as internet access. Kamine varsity field house also has locker rooms for visiting teams, officials, and Lafayette’s coaching staff as well as an air-conditioned training room with two whirlpools, ultrasound, electrical muscle simulator unit, and many pieces of rehabilitative equipment.

The picture above is of the sports complex at the Metzgar Fields Complex. The Kamine Varsity House is circled in red.

The carbon capture project will use this building as a micro model for the school. According to the EIA, in 2017, the average annual electricity consumption for a U.S. residential home customer was 10,399 kilowatt-hours (kWh), an average of 867 kWh per month. That means the average household electricity consumption kWh per day is 28.9 kWh (U.S. Energy, 2019, n.p.). In 2018, emissions of carbon dioxide by the U.S. electric power sector were 1,763 million metric tons or about 33% of total U.S. energy-related CO2 emissions of 5,269 MMmt (U.S. Energy, 2019, n.p.). The average U.S. household produces 7.5 tons of CO2 equivalents per year. A mature oak tree can absorb as much as 48 pounds of carbon dioxide per year and can sequester 1 ton of carbon dioxide by the time it reaches 40 years old (U.S. Energy). Therefore, it would require 300 mature oaks to cancel the carbon emissions produced from powering the Kamine Varsity house.

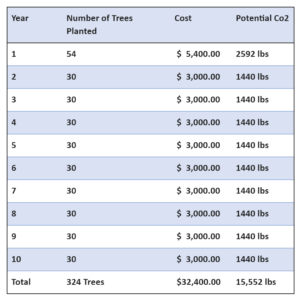

This small model can be used by the school to determine how feasible it would be to reforest enough land for Lafayette College to be carbon neutral. It would cost the school $32,000 to plant 320 trees priced at $100 a tree. As explained in the technical analysis, there are two reforestation alternatives. The combination of the 300 department-sponsored trees and the 24 oak trees for the oak tree walkway would plant a total of 324 trees.

The department-sponsored tree project would require each department to plant one tree per semester. Each department will have the option of which tree to plant. On average, native youth trees cost under $100. In total, Lafayette College would have to spend $3,000 annually for this alternative. The oak tree walkway would be a one-time payment to install the trees. Using the same pricing of $100 per tree, this alternative would cost $2,400 to purchase the 24 oak trees.

The combination of both projects would nearly compensate for the carbon produced by the Kamine Varsity field. The two alternatives would cost $32,400 over ten years, roughly $3,240 per year to implement. Planting oak trees alone will not make Metzgar Field carbon neutral by 2035 because oak trees are fully mature in about 40 years. If implemented today, these alternatives will create a foundation that will offset the carbon produced in the Kamine Varsity house by 2065.

The price estimate for both alternatives shows the price of purchasing the trees and does not account for the installation labor. Metzgar athletic field has a landscaping company that could plant the oak tree walkway. Students in each major could plant the department-sponsored trees. If students and Metzgar field landscaping companies plant the trees, there would be no labor cost.

Lafayette College campus contains significantly more buildings that are all much larger than the Kamine Varsity house. It would require a much larger reforestation project to cancel out the carbon produced by the college. The college would have to scale the whole project and reforest a much larger plot of land. As mentioned in the cost-benefit analysis, Lafayette College would have to plant 17,289 acres to compensate for the on-campus emissions. Oak trees require a minimum of 25 feet between each rootball to grow to full size. Therefore, spaced 25 feet apart, it would take 64 oak trees to cover 1 acre of land. Sixty-four oak trees multiplied by the total acres are 1,106,537 trees. Priced at $100 a tree, it would cost Lafayette College $110,653,700 to purchase enough trees to reforest 17,289 acres of land.

In conclusion, phase one, Lafayette College will plant 324 trees for $32,400. Along with making Kamine Varsity House carbon neutral, this phase will serve as a micro model for the school to follow. Phase 2 will reforest the remaining 120 acres of land. Following the same pricing of $100 per tree and 64 trees per acre, this phase will cost $768,000. Phase one and phase two together will plant over 8,000 trees and cost over $800,000. In total, this number of oak trees will store 384,000 lbs of carbon each year, which amounts to roughly 1% of the college’s total carbon emissions.

Existing financial circumstances

Different financial circumstances must be taken into consideration when implementing sustainable projects, such as carbon capture and storage at Lafayette College. The Climate Action Plan 2.0 mentions “making an initial investment in tools and resources with quick payback periods… [through the] establishment of a green revolving fund that will allow us to undertake higher cost capital projects that will be crucial to achieving our goal of carbon neutrality.” The Green Revolving Fund is a fund that Lafayette College needs to work towards implementing because it will help with establishing a set fund that can make not only the carbon capture storage project a possibility, but as well as other sustainable focused projects. Moreover, the college has previously received funding from the Clinton Foundation and the Mellon Foundation. Because the established relationship and knowledge happened before the CAP and CCS, it will be easier for the college to petition for funds to support such technologies. The costs required for either organic farming or the micro model reforestation should not be more than approximately $50,000. When comparing this amount with other expenses that Lafayette has, it would be a significant investment and not as an expensive option towards moving forwards with carbon capture and storage technologies. Some of the benefits of implementing CCS will include less energy usage required, fewer carbon emissions, and higher profits for farmers when applying organic farming (Rodale Institution, 2019). To be successful, Lafayette College must ensure there is a strong foundation in which students, professors, and others can rely on a fund that will help towards implementing sustainable projects and help reach carbon neutrality by the year 2035.

External funding from government and NGOs

The external funding for our project could consist of government grants from federal to state and funding from environmental organizations. The Pennsylvania Farm Bill passed in 2019 has four relevant funding projects that could apply to our case. The first one is Realty Transfer Tax Exemption, a grant for any transfer of preserved farmland to a qualified beginning farmer. As discussed in the political context, leasing the land to a farmer could be a win-win choice. By selecting a qualifies beginning farmer, we might be eligible for this fund as well. The second one, Conservation Excellence Grant Program, funded at $2.5 million, is to provide financial and technical assistance to farmers to install and implement best management practices. This assistance could aid with either organic farming or agroforestry alternatives. The third one is Pennsylvania Rapid Response Disaster Readiness Account, funded at $5 million, to allow for a quick response to agricultural disasters, including actions to contain an outbreak or threat, such as Spotted Lanternfly. The selection of oak tree species as a reaction to Spotted Lanternfly in our alternative provides the opportunity to apply for this fund. The fourth one, P.A. Preferred Organic Initiative, funded at $1.6 million, is to make Pennsylvania the nation’s leading organic state by further enhancing the growth of the organic industry and closely aligns with the development goal of LaFarm. Before this new bill, there exists an Environmental Quality Incentives Program funded by USDA that enables eligible farmers and landowners to receive financial and technical assistance to install conservation practices needed to protect natural resources as part of their certified organic or transitioning to an organic operation.

Other than U.S. government funding, the global carbon market mediated by NGOs could provide carbon credits to fund this project. Indigo Carbon, a startup in Boston, gives growers who joined in the 2019 crop season $15 per metric ton of carbon dioxide sequestered. The VCS Program, the world’s most widely used voluntary GHG program, has a sophisticated system of rules and requirements for projects to follow to be certified. After certification, it issues project developers available GHG credits called Verified Carbon Units (VCUs). The VCUs can be sold on the open market and retired by individuals and companies to offset their carbon emissions (Verra, 2019). One project certified by this standard is the Bethlehem Authority Improved Forest Management Project Area, a 17,591-acre split-parcel situated in Monroe County and Carbon County, Pennsylvania. It received 7082 VCUs, which is approximately a quarter-million dollars’ market value.

To read the Conclusion of our report, click here.