This project has a broad focus because it contains information involving processes inside and outside the Lafayette College community, focusing on the overarching problem of e-waste buildup in the world, but seeing how this applies to the Lafayette community. This analysis of the economic parameters of this project applies mainly to the Lafayette community, or mainly in the ways that this project applies to the Lafayette community.

One of the most important aspects of completing an effective electronics life cycle analysis is taking into account the cost of the electronics. Particularly, the most important aspects are the materials that make up the iPhone, the cost of the product, and the price or cost to the consumer at the end of its useful life. Taking into account all of these parameters, we decided that a Technical Cost Model (TCM) would be the most effective way to represent the important monetary values at play in this project. A Technical Cost Model breaks down a product into its basic parts and models the costs for those specific inputs and outputs. By collecting this data from the actual life cycle, we can show members of the community the value of what they and the rest of society are paying for.

Technical Cost Model (TCM)

The raw materials were chosen as an economically important aspect of the e-waste life-cycle to the Lafayette community because they are the first and one the last steps in the life of the product. The raw materials are a large aspect of why e-waste recycling is an important topic. As shown in the model, these materials can be very valuable and almost all e-waste is recyclable. The materials include are the main materials, and do not include some rare earth metals that are mainly used for aesthetic purposes. They can also have very interesting backgrounds, as these materials come from all of the world. The origins of these raw materials can create more interest in recycling them, and understanding the stakeholders and value is a key part of that. For example, one such element is tantalum, a rare lustrous metal used in microprocessors to control electricity flow. Although Apple claims that it obtains its tantalum conflict free, as opposed to supporting the tyrants and warlords that profit from its trade in the Democratic Republic of the Congo and Rwanda, the frequency of unmonitored trade activity in the tantalum market means Apple cannot make that claim with confidence. Apple does not make any such claim for gold, tin, or tungsten, similarly conflict-associated materials (Desjardins, 2016).

Because we focused heavily on the cost of the raw materials themselves, we did not touch on the cost of the components that the raw materials make up. This would have included the manufacturing of the components, and the salvage value. The main reason not to mention this as an important economic aspect of the life-cycle to the Lafayette community is because students are not involved in that process, are unlikely to resell parts of their iPhone, and the components have different resale and recycling values depending on the buyer of the used components. We also do not intend to model the cost of a product’s design or that of its software/operating system. For the purposes of this lifecycle map, we are focusing the vast majority of our efforts into the physical aspects of the products, as the software is not the tangible part of electronics that manifests e-waste. Though costs of steps in the overall creation and mass production of widely used products are important to take into account when evaluating costs of bringing the iPhone to market, they are not important in mapping the physical product. This is why such steps as design of the product, design of the operating system, software download and quality assurance, assembly and distribution, are not included in this economic model.

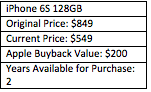

The next part of the TCM is the price of the iPhone. For the purposes of this project, we thought it was particularly important to focus on the cost over time in the model. For this reason, the original price listed for the iPhone in late 2015 is visible, as well as Apple’s current price for the same product, and the current listing on Apple’s site for the salvage value. As mentioned in the introduction and social context sections, planned obsolescence as a manufacturing ethos is a crucial influencer of the electronic life cycle. Products are meant to have a set lifespan before being replaced by their updated successors. For the most part, Apple produces a new or updated model (i.e. iPhone 6s, iPhone 6s Plus) of the iPhone on a yearly basis. Normally, each time Apple produces a new model, the model that preceded it will decrease in price by $100 (Broida, 2017). Additionally, through a study done in 2013, Usell.com found trends within weeks weeks of the launch. They found that “Two weeks after a new phone launch, old iPhones lose about 11% in value. Four weeks after launch, old iPhones depreciate about 15%. Six  weeks after launch, old iPhones depreciate about 18%. By week seven, old phones are worth about 21% less (Huddleston, 2014).” As shown in the model, two years after the iPhone 6s was released, its price from its own producer has decreased by $300, instead of the average $100 per year.

weeks after launch, old iPhones depreciate about 18%. By week seven, old phones are worth about 21% less (Huddleston, 2014).” As shown in the model, two years after the iPhone 6s was released, its price from its own producer has decreased by $300, instead of the average $100 per year.

The TCM does not, however, include the cost of the actual recycling process. This is because not only Lafayette, but individuals, corporations, other colleges etc., do not participate in the process of physically stripping down old electronics to their raw materials. For our purposes, we are focusing on how Lafayette recycles its e-waste. Our project is not about evaluating the practices of the companies that perform the services laid out in the technical section. We will continue to focus on finding information from the school on the cost of Electronics Recycling Day, now through Information Technology Services. Our focus on these sources of recycling is more aimed at its cost-benefit ratio to the consumer (members of the Lafayette community) as opposed to throwing away or keeping old electronics.

It also does not include the cost of recycling products at Lafayette. This is because particularly for students, there is not really a system in place to handle e-waste, besides Electronics Recycling Day, which is free for students to participate in. Responsible Recycling Services is the organization that handles Electronic Recycling Day, and could be used in the future if the school wanted to bolster its program. However, the scope of this project is mapping the current e-waste life-cycle at Lafayette, not to plan and model a possible future system. The current system that is in place for students are the Big Green Boxes. ![]() The school uses the company Big Green Box for recycling student and faculty batteries. According to Marie Fechik-Kirk, Director of the Office of Sustainability, the school has about 10 of these boxes out at a time. Each box includes the transportation and disposal costs, and cost $63 each. These boxes hold 43 pounds of batteries (BigGreenBox.com).

The school uses the company Big Green Box for recycling student and faculty batteries. According to Marie Fechik-Kirk, Director of the Office of Sustainability, the school has about 10 of these boxes out at a time. Each box includes the transportation and disposal costs, and cost $63 each. These boxes hold 43 pounds of batteries (BigGreenBox.com).

Another aspect in addressing e-waste involves tax deductions, the most intuitive being charitable donations. Whether donating money, clothes, or electronics, “charitable donations” to non-profit and charity organizations are often used for tax exemptions. Deductions of $500 or below are allowed to be self-reported, so individuals can actually report the prices that they believe are at “fair market value.” Values must be reported through a 1040 federal form. Donations exceeding $5000 require written appraisal of the property’s fair market values (On Earth Day, 7 Tax breaks for Going Green). Any of these donations must be to a qualified “charitable organization,” which can be confirmed by the Internal Revenue Service (IRS) Exempt Organizations Select Check. (Phillips, 2017)

Tax incentives for recycling are mainly focused on larger companies rather than individuals. The Environmental Protection Agency (EPA) does not offer any direct credits or rebates. “[The EPA] does keep a listing of state programs that provide incentives to companies. Twenty-five states have some type of program, usually tax incentives or credits, to promote recycling market development. Some states offer a fixed amount of money. Delaware gives $500 towards equipment costs, as of August 2011. Others offer a percentage of value that can range from 10 to 50 percent. (Sanders, 2017). For states that offer percentages, the value of electronics can be significant.

In terms of dealing with electronic waste, Lafayette is an institution that donates its e-waste, which is one potential option to minimize the amount of e-waste that ends up in landfills. In particular we focus on the properly certified non-profit agencies to which Lafayette donates electronics that do not have value to the college, but have value to “qualifying organizations that have requested used equipment (its.lafayette.edu).” After speaking to Marie Fechik-Kirk, we found that the school is listed as a tax exempt organization, so any tax exemptions that may serve as an incentive to recycle e-waste are moot. Lafayette qualifies under section 501c of the Internal Revenue Code of the IRS (Exemption Requirements – 501(c)(3) Organizations, irs.gov) because they are an educational institution. Tax breaks, therefore, are not relevant to the school. Fechik-Kirk also said that any fines for not recycling electronics waste are likely few and do not provide sufficient incentive to the school.

The school does not technically have a strict monetary incentive for bolstering its current recycling program. However, a very important incentive to take into account for doing so is publicity. Implementing sustainable practices throughout an institution is a very hot topic, particularly for schools that have dominant programs in engineering. Marketing a school is therefore very important in bolstering a school’s image, and the school’s image and rankings are economically very important because it can increase the inflow of applications, overall publicity, and possible donations. Creating a sustainable environment is part of creating a better and more inviting college environment. This bolster ratings which boosts publicity. The average college campus spends about $1190 on marketing per student. About 56% have attributed increases in both applicant quality and perceived academic reputation to the work of their marketing functions. (Hanover, 2014) These reputations do matter a lot. For example schools landing in the U.S. News and World Report’s Top 25 will experience a 6-10% increasing in the volume of incoming applications. Schools making Princeton Review’s Top 20 Best Overall Academic Experience will see a 3.2% surge in applications. In fact, colleges that move just one percentage point upward in U.S. News rankings will see a corresponding 1% increase in applications received. (Tomar, 2016)