Third Party Financing

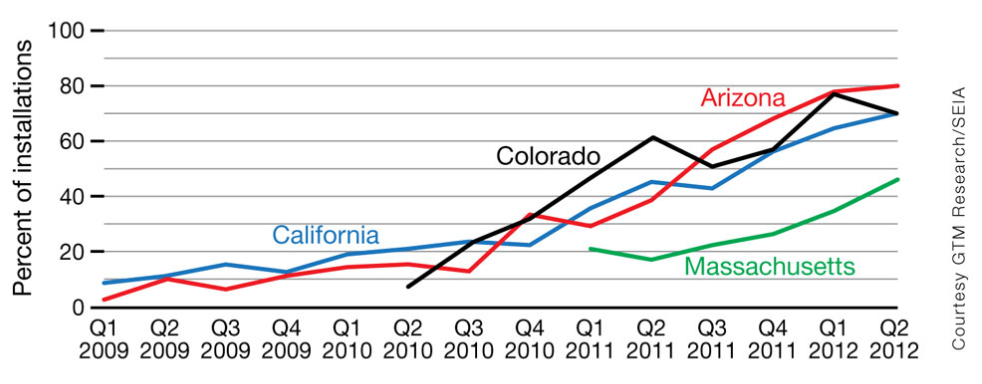

Since third party financing was introduced in 2007 to the solar industry, the PV market platform has seen incredible changes. A key component of the third party financing model is that it eliminates one of the largest barriers of entry for solar PV investment, high up-front costs. The dominant model for third party financing is the power purchase agreements (PPA’s). Through a shift toward this system costumers receive new economic incentives for solar PV investment. Another type of third party financing occurs through a traditional lease between the contractor and consumer. The figure below shows the rapid expansion of third party leases within a very small time frame for solar PV installations in the residential market. The lines represent the percent of installations that are through third party financing models. [1]

Power Purchase Agreements (PPA)

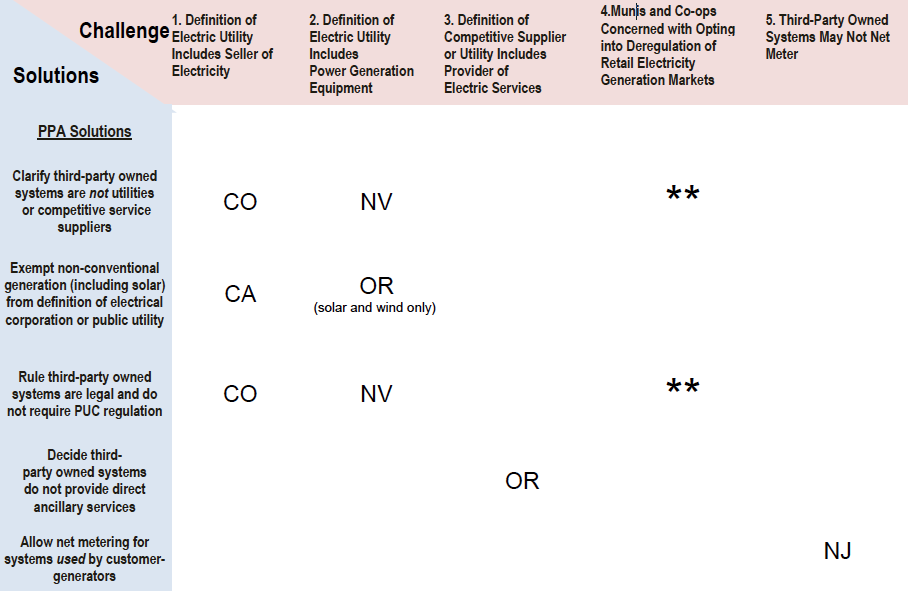

The power purchase agreement is unique in that there are no up-front costs for the landowner. With the developer financing the up-front cost of the solar system, the consumer no longer is responsible for the risk associated with the capitol investment. An installer/developer sets up the system on the land, operates the equipment, and then sells the electricity back to the landowner at a fixed rate, typically lower than the local utility cost. The consistent low rate for electricity is an integral part of the agreement. [4] The cash flow, REC’s, and electricity flow within the PPA model is explained in the figure below: [2]

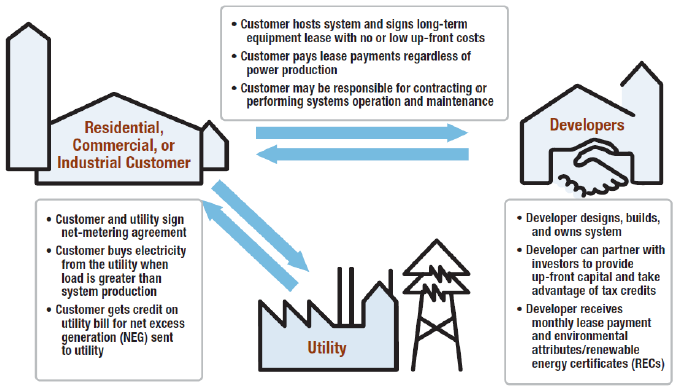

The developer derives revenue by profiting from electricity sales to the landowner, REC’s sales to the utility provider, cash incentives, and incentives from federal and state policies. [2] It is no surprise that the PPA model’s success varies across the country and globe depending on the laws and regulations that exist for that region. The figure below provides a visual representation of the the advantages that different power purchase agreements could provide: [2]

Challenges

State legislature and regulation pose the greatest threat to the third party financing PPA model. These obstacles are associated with whether or not the state recognizes the third party owner as a monopoly utility, competitive electricity supplier, or both. Other areas of uncertainty are whether the the systems can also implement net metering. Since the agreements are relatively new there are high levels of uncertainty and state policy across the country are extremely inconsistent. There is a lack of clear distinction for how the third party owner should fit into the existing retail electricity market. PPA’s do not work when the state determines that their electric utilities and electric services qualify the PV systems to be regulated by state utility regulators. [3]

Solar PV Leases

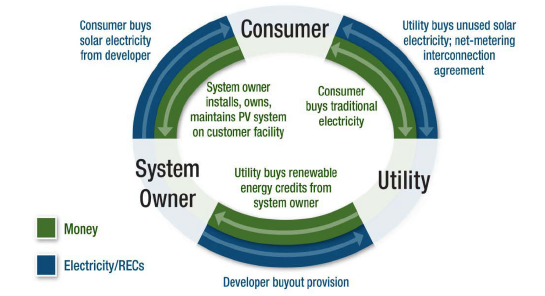

An alternative option the the power purchase agreements is a traditional lease structure, which can be called the solar service agreement (SSA). Using the SSA platform the landowner pays the installer/developer for the use of the equipment, typically on a monthly basis. The electricity produced by the PV instillation will be directly subtracted from the consumers electricity bill. Additional electricity will be accounted for through net metering, assuming it is eligible within the region. Benefits from the SSA model are no up-front costs, lower monthly electricity rates, and depending on the contract, fee operation and maintenance. One downside is that the consumer is not paying a fixed price for electricity as one would through a power purchase agreement. This is because the landowner is paying a flat price for leasing the system, but the market for electricity prices fluctuates. Solar leasing companies do benefit from levying tax incentives similar to developers using the PPA model. The figure below displays the basics of the solar service agreement between the customer, developer and utility provider: [2]

For more information view: [1] [2] [3] [4]

Primary Author: Benjamin DeForest

Primary Editor: Apratim Mukherjee

The third-party PPA model is quickly becoming the financing method of choice across a wide range of PV generation market segments and is even finding a niche in the residential and federal markets. However, use of this finance model may be inhibited if it conflicts with state legislation and regulation that was established before third-party ownership was used to finance renewable energy projects.. The diagram providing a potential solution to these cost challenges is a model in which a third-party owner uses a power purchase agreement (PPA) to finance an on-site PV system. This model—the third-party PPA model—allows a developer to build and own a PV system on the customer’s property and sell the power back to the customer.

Solar energy system prices have come down, tremendously, over the past few years. But if a cash purchase is not practical then it may make sense to use debt (loans) to procure a solar energy system. However using a lease to install a solar energy system is often not an efficient or wise way to use your investment money.