U.S. SECTOR-WISE INSTALLATION

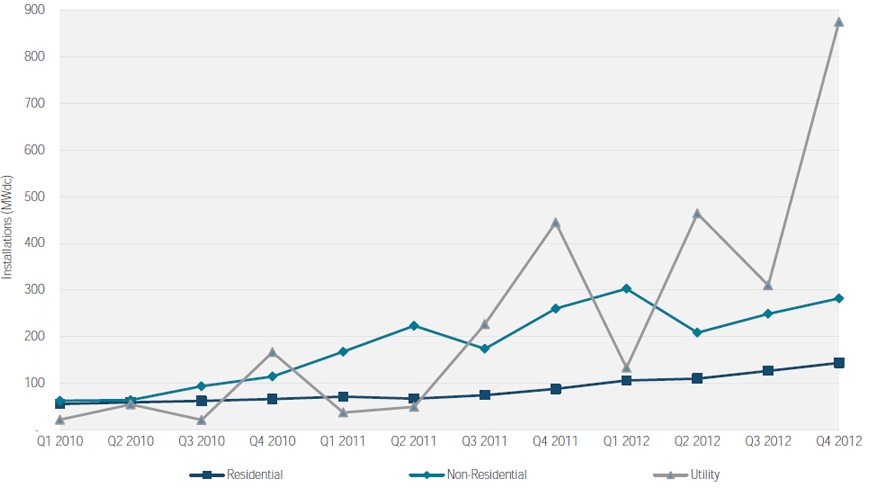

In terms of sector wise installation, the U.S. utility sector has shown the most growth recently, with a doubling of growth in 2012 over 2011 to reach 1781 MW installed as shown by the figure to the right. 2012 was a watershed year for solar PV growth in the utility sector since about eight of the ten largest projects currently in operation were completed in 2012. This marks a stark departure from 2010 and 2011 during which residential and non-residential sectors consistently led the utility sector in terms of solar PV installations. It is also interesting to note that the PV installations for all 3 sectors (utility, residential and non-residential) increased during the 4th quarter for all of the years shown in the graph. This can be attributed to the increased need for heating during the winter period which co-incides with the fourth quarter. [1]

According to the U.S. Solar Energy Industries Association (SEIA), over the next few years a reduction in installations in the utility sector can be expected as late-stage solar PV projects are completed.

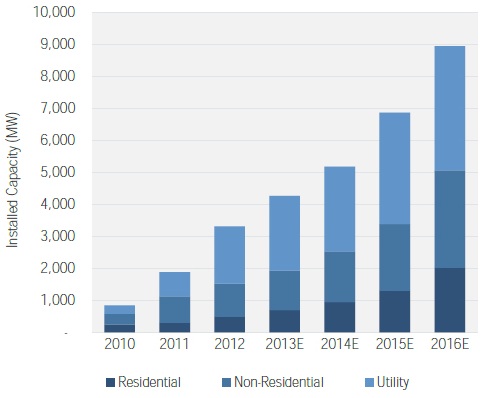

Additionally, assuming that the investment tax credits are not expanded beyond its current deadline of 31st December, 2016, the year 2015 is expected to show a tremendous rise in installation projects across all sectors with developers rushing to complete their projects before the credits are removed as shown in the forecast figure. [1], [2]

U.S. LAND REQUIREMENTS

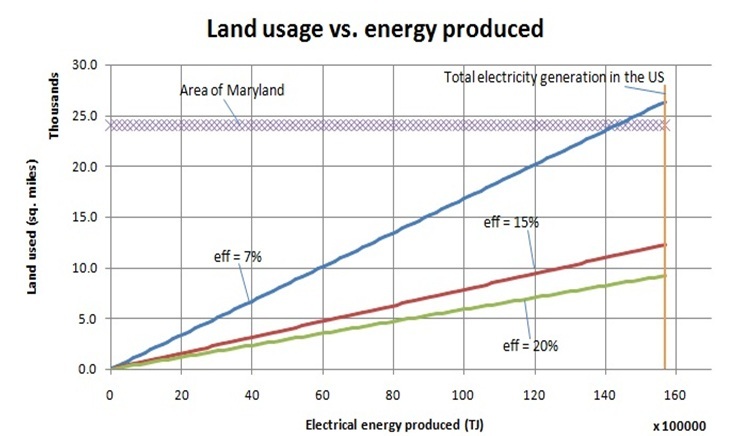

Along with the solar resources available, it is important to consider the available land resources. To this effect, an original calculation was performed to determine how much land would be required if all of the current electricity generated in the U.S. was to obtained from solar PV panels with varying efficiency values. (Details of the calculation can be found in section B of Appy’s methodology section located here.)

The graph shows that for the lowest efficiency under consideration (7%), the total land required to generate all of the U.S. electric energy demand is only 10% higher than the area of Maryland, the 9th smallest state in the U.S. This would suggest that there is an abundance of land resources available for generating electrical energy in the U.S. Additionally, since an increasing number of solar PV installations over the last few years have been focusing on roof-top installations, the possoible lack of land resources does not appear to be a critical issue.

GLOBAL INSTALLATION TRENDS

A look at the global installation trends of solar PV reveals some interesting patterns. Till about 2012, Germany was the leader in solar PV installations, but from 2013 onwards, China took up the mantle as the leading installer of solar PV and has been at the number one position till date (Note: this particular graph was constructed in 2012 and hence the 2013 and 2014 data are projections based on available data. However recent data on the solar PV boom in China corroborates these projections and can be found here ). The consistent growth in the U.S. solar PV installations can also be viewed at a glance from the graph. It is interesting to note that the U.S. and China had similar growth rates of solar PV up till 2013 when the Chinese solar PV market boomed. A CNY 1 (16 US cents) per kWh feed-in tariff for large PV projects connecting to the transmission grid which ended on 1 January, 2014 was one of the major drivers behind the growth of solar PV in China. Latin America is also expected to hit the 1GW annual solar power installation milestone later in 2014. , Latin America installed about 300 megawatts (MW) of solar PV power capacity in 2013, is projected to install about 1,400 MW in 2014 which would constitute almost a four fold increase according to market research firm IHS. [3],[4], [5], [6]

Authors & Editors: Apratim Mukherjee & Joe Donatoni