While the United States federal policy has had huge impacts on the solar PV market, varying levels of success across the country suggest that state and local policy are the determining factor. The example explored on the ‘Power of Policy’ page illustrates that it is not the efficiency or resource that encourages or prohibits success, it is the policy. States that have seen rapid growth in the industry are praised for their policies on net metering, tax exemptions, grid integration, and renewable portfolio standards.

Net Metering

http://www.seia.org/policy/distributed-solar/net-meteringNet metering accounts for the excess electricity that is sent into the grid. This electricity is subtracted from the electricity used and the customer is then billed by the utility company for their net electricity use. Sinceit is very difficult and inefficient to store electricity, net metering is an extremely important policy for making the technology cost effective. Although there are currently 43 states and Washington DC have established net metering policies, they almost all differ in their specific regulations. Differences can be in the rate that the electricity sent to the grid is accredited, caps on how much electricity can be accredited, rollover of electricity credits, and connection fees. New Jersey and Arizona’s no cap policy is an example of solar friendly net metering legislature. It is no surprise that these are two of the leading states in terms of solar PV installations and capacity.[1]

Property Tax Exemptions

Another type of pro-solar inventive is the property tax exemption. With the tax exemption, solar PV owners can exclude the value of the systems when evaluating their assets for tax purposes. Property tax exemptions vary from between different state. It is important to not that states collect property taxes through local governments, and it is because of this that some states have allowed the local taxing authorities the power to give the tax exemptions. There are currently 38 states in America that offer this incentive. [2]

Sales Tax Exemptions

Sales tax exemptions differ on the state and local level. By exempting the purchase of solar PV technology from sales tax, the law decreases the large up-front cost of investment in photovoltaics. Currently, there are 29 states that have some sales tax exemptions for renewable energy. [2]

Renewable Energy Standards (RES)

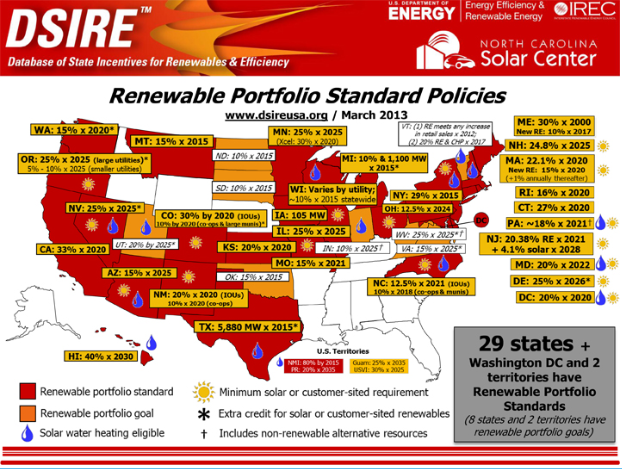

States RES require a percentage of their energy production or consumption come from a renewable energy source. Renewable energy standards have been established in 29 states, but there requirements vary greatly in percentages and time scales. [3] The figure below reveals the different RES across the United States. [4]

For more information view: [1] [2] [3]

Author: Benjamin DeForest

Editor: Amos Han