Federal policy is essential to the industry not only for directly cutting costs, but also for creating market certainty. Due to Solar PV’s young age, small global energy market share, and long payoff period, market certainty is imperative. Federal policies such as the Department of Energy Loan Guarantee Program and MACRS Depreciation are examples of legislatures that have been implemented by the United States Government to give investors the confidence to make long term investments. By helping customers finance the large upfront costs, policy can drastically lower the barrier for entry into the PV market.

Solar Investment Tax Credit (ITC)

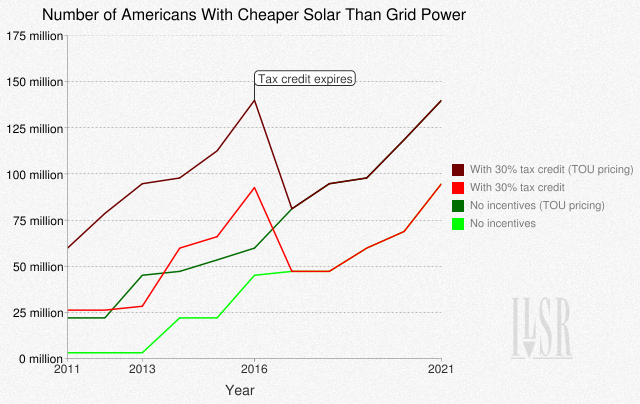

Solar Investment Tax Credit alleviates a portion of the burden from federal taxes for residential and commercial investment in solar energy equipment by providing a 30% tax credit. Since the tax credit was set into law in 2006, investments have had a compound annual growth rate of 76%. The policy is set to expire in 2016. The assurance that the policy would be in place until 2016 has developed market certainty for the past seven years, and the industry’s expansion over this time speaks to the program’s success. With the rapid approach of 2016, the renewal of the solar investment tax credit is an area of focus for policy leaders. [1]

The figure featured to the right displays how important the tax credit is for the solar industry in order to keep the energy cost-competitive. While the image does provide a positive outlook for solar PV as a whole, it clearly illustrates how interconnected the successes of PV’s and the tax credit truly are.

DOE Loan Guarantee Program

Another initiative that has played a huge role in the increase in solar photovoltaic investment is the DOE’s loan program. The program provides large companies with competitive long term financing contracts in the commercial marketplace. The loans are dependable and increase price security for customers. Since the program was established in the Energy Policy Act of 2005, it has helped finance 28 projects. The SEIA reports that the policy has helped to stimulate over $25 billion in private investment. [2]

MACRS Depreciation

The Modified Accelerated Cost Recovery System (MACRS), allows for businesses to recover their initial capital investment for tax purposes. In accounting, Accumulated depreciation is a contra-asset that shows how much an asset’s value has decreased because of wear-and-tear or loss of useful value over time. Depreciation is accounted for over a specific pay period, typically on an annual basis. Businesses can total their accumulated depreciation and form a “Depreciation Expense” account. This account can be used in the books to show investors that their net income is lower based on the decrease in value of their assets. In return, companies pay less taxes and increase their annual revenue. The federal government provides MACRS Depreciation over a 5 year recovery period to investments in solar PV technology. The depreciation method is an incentive because it makes the high up front cost of solar photovoltaics more economically feasible.

For more information view: [1] [2]

Primary Author: Benjamin DeForest

Primary Editor: Amos Han