Marketing Director Jack Evans ’22 and Alex Hunter ‘24 broke down the market’s performance this week and the biggest stories on Wall Street.

The market was up around 1% across the board, with the Dow closing above 34,000 for the first time on Thursday. The market was primarily driven by strong earnings and positive economic data. Some major headlines of the week included the J&J vaccine pause, Coinbase, and positive U.S. economic data. Federal health authorities recommended Tuesday that providers stop administering the J&J Covid-19 vaccine, while they investigate 6 cases of blood clots. The news had little effect on the overall market, JNJ fell 1.3%. Shares of Coinbase, the cryptocurrency exchange platform, soared in its Nasdaq debut. Reaching as high as $429 a share, where its market cap exceeded $100 Billion. Coinbase supports trading for over 50 cryptocurrencies and this is seen as a big win for the Crypto Industry. US retail and food sales jumped 9.8%, in part, due to stimulus checks sent out last month. Food and Drink has reached 95% of pre-pandemic levels and retail sales are 27.7% higher than one year ago.

Why are earnings important? Earnings show the profitability of a company and are used to evaluate a company’s stock. They are used as one of the primary ways investors analyze past growth and predict future growth. To date, 34 companies in the S&P 500 have reported first-quarter earnings. Of those, 88% have beaten their Q1 2021 EPS estimates by an average of 22%. The winners thus far include Goldman Sachs and JPMorgan Chase & Co. Goldman reported revenue of $177.7 Billion crushing estimates of $12.2 Billion. JP Morgan also crushed earnings, driven by their trading operations which beat estimates by $1.8 Billion. Most of the club’s portfolio has not reported yet, some notable holdings reporting soon are IBM, Intel, and Boeing.

ESG Analyst Nick Tufano ‘23 presented the club with its commitment to ESG investing and our goal of maintaining a portfolio rating of at least BBB. You can read the full commitment here.

Industrials Analyst Ian Lee ‘22 updated the club on the current standing of Southern Copper. Our new club ESG rules do not allow holding stocks with ‘laggard’ ratings for 2 or more consecutive quarters. Therefore, we are looking at selling Southern Copper, which holds a CCC rating. This proposed sale will increase our cash position by $26,600. Where should we reinvest this? Ian thinks that we should use this cash to expand our Industrials sector. Industrials have outperformed the broader market in the past 6 months. Demand for copper and other metals is projected to keep increasing through 2021.

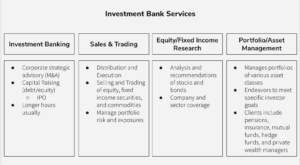

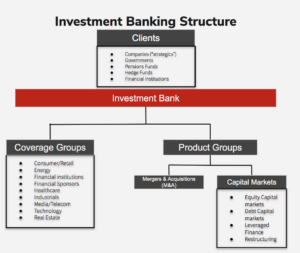

Co-President Noah Grossman ’21, Vice President Connor Thatcher ’21, Chairman of the Board Parth Patel ’21, and TMT Analyst Nick Sant Foster ‘22 explained the complex segments of a Bank.

In movies, the sales and trading floor is seen as a chaotic screaming match amongst angry traders. However, there is much more to sales and trading than that. Salespeople communicate information about securities to investors. Sales has the goal of convincing potential investors that the firm’s traders are better than traders working for competing financial firms. There are two types of trading. Agency trading’s goal is to execute trades as skillfully as possible on behalf of the firm’s clients. Proprietary trading is trading the firm’s own money.

Equity Researchers provide investors with detailed financial analysis and recommendations on whether to buy, hold, or sell a particular investment. They also support investment banking and sales & trading clients by providing timely, high-quality information and analysis. The contents of an equity research report typically include Industry research (competitors, trends, etc.), Management overview and commentary, Historical financial results, Forecasting, Valuation, Recommendations.

Asset Management is the management of all assets with a focus on investments.

They help with asset allocation and generally deal with institutional clients. These clients include pensions, insurance, mutual funds, hedge funds, and private wealth managers. Asset Managers earn money based on percentage of AUM.

Wealth Management takes a much broader approach to managing financial success. Wealth Managers look at an individual or family’s overall financial situation and taking steps to maximize their wealth and protect it down the line. Their responsibilities include Tax planning, Education planning, Legacy planning, Estate planning, Insurance, Charitable giving, Retirement planning.