Sam Kirby ’22 kicked off our General Body Meeting by providing an overview of the of S&P 500, Dow, and Nasdaq’s performance for the week. S&P finished the week down 0.50% and closed at 3,483.81. The Dow also finished slightly lower, dropping 0.23% and closing at 28,606.31. The Nasdaq fell off towards the end of the week and ended down 0.71% at 11,671.56.

Sam also took a look at some of the biggest stories in the business world this week, as Apple unveiled their new iPhone 12. The phone will be 5G compatible and sales could benefit from a massive iPhone upgrade cycle in the coming months. Pre-Ordering begins on 10/16, and they will go for an estimated $800+ for the standard model.

Amazon held its highly anticipated annual Prime Day from October 13 through the 14th. Prime Day allows Amazon Prime members to take part in a special savings event with incredible deals on amazon.com. It is estimated to have generated over $9.8mil in sales for Amazon, which is up 43% from last year. Analysts predict that there will be an increase of 14.9% Prime Users in the U.S. in 2020 (142.5 Million people), making up more than 50% of the U.S. population for the first time.

Some of the top performers of the week included Staffing 360 Solutions (STAF), SPI Energy Co Ltd. (SPI), and Bank of America (BAC). Shares of SPI soared roughly 105% on Thursday, due to the company’s announcement that they would be adding electric vehicle and EV charging to its business. The worst performers of the week were Fastly Inc. (FSLY) and Tesla Inc. (TSLA). Fastly is a cloud computing services provider and their stock plummeted 31% on Thursday and Friday. The stock experienced a sell off due to poor expectations for its Q3 earnings performance. Tesla on the other hand fell 5% to close out the week.

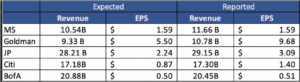

Up next, Chairman of the Board Parth Patel ’21 broke down the Q3 Earnings for airlines and banks. Morgan Stanley and Goldman Sachs were the highlights of the group, beating estimates despite a severe decrease in M&A activity. On the opposite end of the spectrum, Bank of America and Citi thoroughly disappointed. BAC came up short on revenue, and their sales and trading fell short as well. Citi was crushed after they reported a 34% drop in profits for the third quarter. Last week Citi was fined $400 million for missteps in risk management and Analysts raised serious concerns about the bank’s future on the earning’s call. CEO Mike Corbat was met with contentious questions such as “Why isn’t Citigroup the next Wells Fargo?” and “Why not step aside now?”. Morgan Stanley and Goldman came out of Q3 as the clear winners, and it will be interesting to see how the banks continue to perform in the current economic environment.

One of the hardest hit sectors in the market also reported earnings this week, as the airlines continue to feel the pain. The airlines are in desperation as it appears there will be no stand-alone airline bailout and they have been forced to furlough thousands of workers. United reported heavy losses on the 14th, announcing that they experienced a 78% decrease in revenue and an 84% decrease in passenger revenue. United tried to keep things positive by citing their decreased cash burn rate, but things continue to look bleak. Delta also reported last week on the 13th, with total revenue falling 76% to $3.06 billion and passenger revenue dropping 83%. Without stimulus the airlines face a difficult road ahead, as demand crawls higher.

Energy Analyst Tate Harobin ’22 analyzed his sector’s recent struggles and how the club should approach its energy holdings. The S&P 500 Energy Sector is down 49% YTD and has been hampered by the fall in oil prices, which are also down roughly 35% YTD. The COVID-19 pandemic has absolutely decimated demand for oil throughout the world. Despite the current outlook, Analysts believe this is the bottom for the energy sector, as the U.S. is trying to push forward economically.

Energy makes up just 1.8% of our portfolio, slightly less than the S&P 500. Chevron is down 39.9% YTD, Exxon is down 51.5% YTD, and pipeline company Kinder Morgan is down 39.7% YTD. With the growth of alternate energy companies, has there been a long term-shift in market? Tate believes that we should hold on to our current holdings, as he sees this as a bottom for the energy giants. However, he also believes that the club should look into investing in some alternative energy companies.

Risk Analyst Shaan Shuster ’23, Mikias Stewart ’23, Chisom Njoku ’23, and Ronald Grose ’24 gave the club’s second stock pitch of the year, pitching SolarEdge Technologies. SolarEdge Technologies (NASDAQ: SEDG) is an Israeli provider of power, optimizer, solar inverter and monitoring systems for photovoltaic arrays. These products aim to increase energy output through module-level Maximum Power Point Tracking. The primary operations of the business are in the United States. Their main products include the SolarEdge Power Optimizer, SolarEdge PV Inverter, and the SolarEdge PV Monitoring Platform.

SolarEdge presents an attractive opportunity to diversify our portfolio into renewable energy, align our capital with ESG initiatives, and invest into an industry leader with proven results and attractive growth prospects. The tailwinds facing the green energy sector will undoubtedly benefit SolarEdge, especially given the start of the secular decline seen in the oil industry. China is the current leader in green energy production. Given the possibility of tariffs being lifted, SolarEdge will draw the attention of more homeowners in China. SolarEdge has made many acquisitions, growing its home energy solution platform, buying an uninterruptible power supply company, and developing an EV inverter product. The company has strong market share, strong financials, and a compelling growth story.

Some key numbers:

- Market Cap: $15.161B

- P/E Ratio (TTM): 90.46

- PEG Ratio (5 year expected): 1.86

- 52 Week Range: 67.02-314.00

- Beta (5Y Monthly): 0.73

- EBITDA (TTM): 236,861,000

- Institutional Ownership: 86.42%, largest owner: BlackRock

- Insider Ownership: 4.46%

Their Annual revenue grew 54.39% from 2017-2018, 52.11% from 2018-2019, and 45.09% from 2019-2020 (twelve months ending June 30, 2020). Despite difficulties from COVID-19, revenue still grew 2.1% for the quarter ended June 30, 2020. Gross margin remained steady at 31-34% range. 2/31/2019 Current Ratio: 3.42, billion-dollar cash position vs 682,954,000 total debt. Analysts are currently rating SolarEdge as neutral.

Despite SolarEdge’s incredible upside, there are several investment risks involved with SolarEdge and the solar industry as a whole. The stock’s valuation is on the higher side, with a price of over $300 and a P/E ratio of 89.94. They also have a very strong competitor in Enphase, which could force them to lose some market share. Enphase is pushing into the massive home energy market with Ensemble energy management technology and its Encharge storage systems.

EnterSolar’s margins could possibly be pressured by shipping costs, tariffs, and need for capacity growth. The main concern regarding the solar industry as a whole is the result of the upcoming presidential election The Election results could severely harm the stock price. Much of the current price runup is likely pricing in a Biden win, and a Trump win would cause a price correction. This is due to the fact that the Biden administration is planning to invest heavily in solar/renewable energy and infrastructure and roll back protectionist trade policies. Even with these possible risks, the pitch team is confident in SolarEdge’s strong growth thesis and proven track record, as well as their exciting acquisition and growth opportunities.

The club voted to approve the purchase and we will be adding SolarEdge to our portfolio. Thank you to all our members for another great meeting! Come to the Executive Board Meetings on Tuesday at 12:20 to get more involved in the club. Zoom links are provided in the GroupMe.