Our fall break didn’t stop the club from hosting its weekly general body meeting this week, with an agenda ranging from our standard market update to an in-depth look at recent and historical interest rates and their consequences on the market at large.

Jesse Glaser ’19 and Luke Cummings ’19 gave us the low-down on the week’s market news and developments. Highlights included rising interest rates, tech stocks’ supply chain issues, increased volatility, and a general weekly downturn for all three major indices.

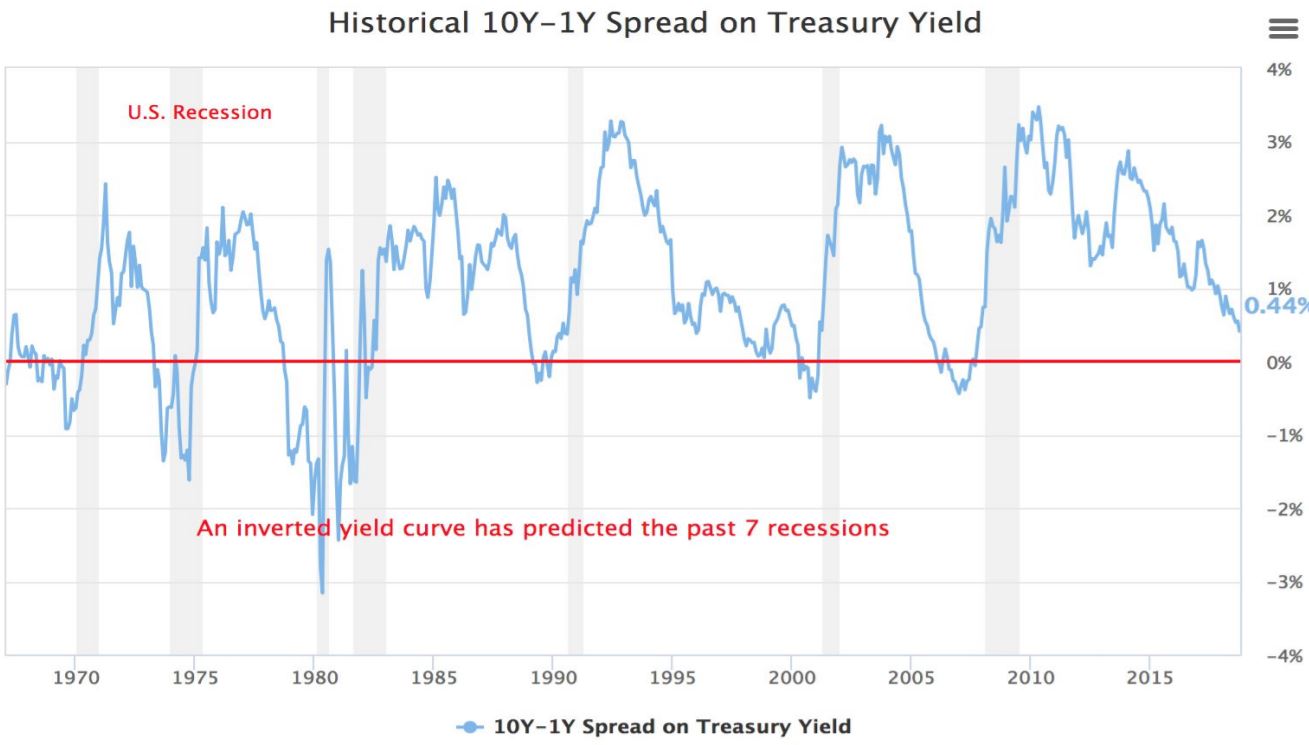

The club’s look at interest rates focused specifically on the 10-year yield increase from 3.25% from 2.82% just two months prior, along with the yield curve inversion and historical tracking, and what consequences are attached.

Other news touched on included inflation updates, with the CPI rising 2.2% year over year, China’s trade surplus in September, Sears’ continuing downfall, and various activist investors’ attempted interventions.

Emmett O’Toole ’20 wrapped up the meeting with a mock interview question, posing the following: What is the expected value of a roll of a die? Beyond the actual question, Emmett talked about how to walk through your resume in an interview, different market-based questions, and an example stock pitch.

See the full presentation here: General Body Meeting 10/19/18