Our first meeting this year post-Involvement Fair was a sellout. Simon L3 was packed to the rafters, filled with students of all class years and from all different backgrounds. The excitement of the room was obvious, spurred by both lower- and upperclassmen alike. The co-presidents started the meeting off with introductions to the Executive Board and the club in general, and then moved into the meat of the afternoon.

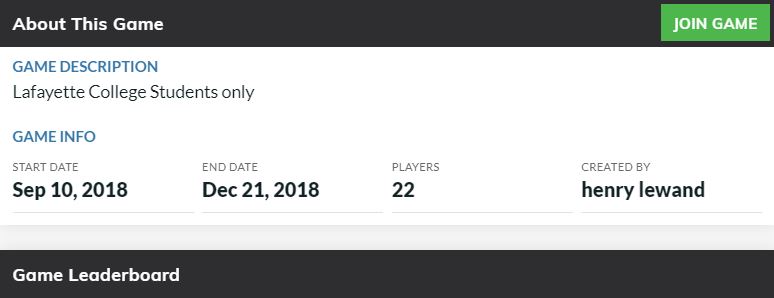

First, Henry Lewand ’21 introduced the meeting attendees to the “Stock Market League” that the club is facilitating throughout the semester. Each Lafayette student that signs up has the opportunity to “invest” $250,000 into their preferred securities, and the three highest-valued portfolios after December 21 will win cash prizes. Check the rankings here if you’re interested.

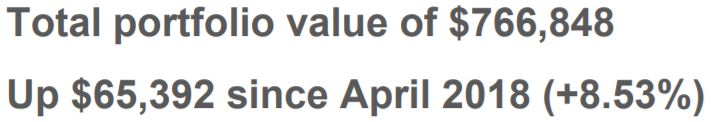

Next came Jeff Sikorsky ’19, as well as the club’s respective sector analysts, who updated the club on the portfolio’s performance over the summer. In short, our holdings rose in value $65,392 (8.5%) since April 2018, including the notable jump of our recent purchase of Canada Goose by over 40%. This semester, and moving forward in general, we hope to more completely answer our own questions of appropriate risk balance and general diversification, especially as we continue to thrive in one of the longest and strongest bull markets in history. More detail on the portfolio’s performance can be found in the presentation at the bottom of this post.

The meeting concluded with an emerging markets segment, describing recent tension and volatility spawned by international turmoil (notably in Turkey, South Africa, and China). Again, more detail can be found in the presentation below.