Introduction:

When I first read John Marshall’s saying: “the power to tax is the power to destroy”, I have no clue about the power. In August of 2021, I made my first attempt to live alone in the United States. It was also my first involvement in the U.S. taxation system. One thing that surprised me was that the percentage and amount of tax are marked in any consumption record in the U.S. This is impressive, in terms of building a basic awareness of taxation among residents. At this level, while nearly all Americans pay taxes, do people really know the classification of taxation systems?

A wealth tax is a tax based on the market value of assets owned by a taxpayer. The idea of wealth tax has been brewing for a long time. However, the introduction of the wealth tax is not appropriate for the society of all time. Also, a lot of proof and experiments are still needed for the introduction of a tax law that targets a segment of the population. Introducing the wealth tax to the taxation system will lead to a series of problems even worse than the problems we are trying to solve by applying it. A specified tax will lead to a loss of taxpayers’ compliance with the government, which will significantly drop the efficiency of the tax collection work. The introduction of the wealth tax could be easily avoided by transferring capital which means the policy is not viable. Finally, the unfairness will only provoke the rich to emigrate which is called capital flight in the academic economy. Regarding the belief that a wealth tax would reduce income inequality, it is pure nonsense, because there is simply not much money to be collected from the rich, who would effectively move their assets.

Discussion:

Unfairness

Taxing specific groups of people is a sign of government injustice, and such an action will reduce the compliance of taxpayers and indirectly lead to the collapse of the tax system. It is clear that adding a tax on a specific group is unreasonable and unfair. Hastily introducing a new tax law would make the government’s credibility and fairness unreliable. Among other things, justice demands of the government the fair and equitable treatment of citizens not only in the courts but also concerning the government’s distribution of public goods and services. This means no discrimination among citizens for wrong or irrelevant reasons. The authors argue that indulgence or targeting specific groups is a sign of government inequity. Any notion of tax fairness attempts to strike a balance between what is fair to the individual and what is fair to society as a whole.

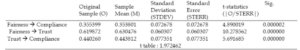

Researchers conducted by Zulhaj et al. (2016), and Syaputra (2019) stated that tax fairness has a significant effect on supporting taxpayer compliance. Taxpayer compliance can be interpreted as a situation where taxpayers are willing to complete all their tax obligations and rights as Table.1 shows. That is, when government inequity is manifested, people’s spontaneity and obedience to tax laws are greatly diminished.

Table.1 Path coefficient. The table shows the significance of the government’s fairness and the taxpayer’s compliance. Also, the table conveys the idea that Fairness is strongly bonded with trust, which is also a key to compliance.

Tax fairness can affect tax compliance directly, or indirectly through the mediation of trust-in-tax authority. This result supports prior studies which suggest that taxpayers will be more likely to comply when the tax system of a country is perceived to be fair. From study results by Yadinta et al. (2018) also shows that justice and understanding of taxes have a positive and significant effect on tax compliance. Therefore, imposing a specific tax would lead to the collapse of the tax system. Is it worth the cost of taxing wealth?

Hard To Collect:

The wealthy certainly have their own legal ways of avoiding the high taxes that are mandatorily levied. Many billionaires will invest in illiquid assets, such as land or private businesses. At a time when the wealthy are forced to sell their assets to pay wealth taxes, a massive sell-off could lead to distorted market prices. Businesses such as the real estate industry can receive damage. Such behavior instead hurts the public and the private businesses.

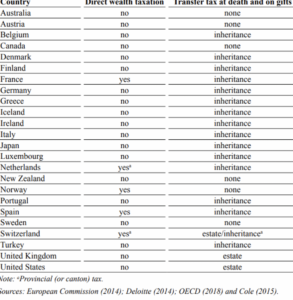

Almost thirty years have elapsed since the publication of the OECD (1988) report on wealth taxation. What was the state of wealth taxation in 2015? This is summarized in Table 2. In 1985, there are eleven countries with a direct wealth tax, but only four of the eleven countries still had this taxation policy in 2015. This result shows that wealth tax is no longer suitable for the current society.

Table.2 Wealth taxation systems among OECD countries, 2015. In the table, we could find out that majority of the European countries gave up the direct wealth taxation.

Wealth Flight:

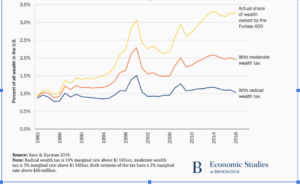

When wealth taxes are levied, assets or funds rapidly flow out of a country due to tax avoidance by the wealthy, and accordingly, the wealthy themselves consider emigration. In fact, even without the implementation of a wealth tax, not a few wealthy people give up their U.S. citizenship each year because of the estate tax. Wealth taxes have also been tried by other Western countries as a means of balancing income disparities, but most countries eventually chose to abandon them. In 1995, 15 European countries were implementing wealth taxes, but now only Switzerland, Belgium, Norway, and Spain still retain the tax. Those countries that have abandoned it have done so mainly because of significant difficulties in implementation, as billionaires would easily give up their citizenship. (Wolff)They would choose to join a country that does not have a wealth tax, making the case for the levy less compelling. There is also a segment of Democratic legislators who believe this problem does not exist in the United States. They believe the U.S. economy is the most dynamic and that billionaires are unlikely to give up their U.S. citizenship. A wealth tax would also provide an incentive to move assets overseas and thereby avoid and evade taxes, as it would be more difficult and costly to find them overseas. The French government estimates that 10,000 people (with a total of €35 billion in assets) left France for tax reasons between 2002 and 2017 when France abolished the wealth tax in favor of a tax on real estate. Such departures would also reduce government income tax and consumption tax revenues. (Suzuki)

Pichet (2007) argues that from 1988 to 2007, the ISF caused capital flight equivalent to about 200 billion euros. Wealthier French “tax refugees” often moved to countries without wealth taxes, taking their assets with them.

Counterargument: wealth tax could solve income inequality

Wolff mentioned that “based on the Gini coefficient, there would be virtually no impact from either tax” (Wolff). Because of the government’s framework structure, the wealthy can avoid taxes by buying luxury goods, investing in foreign projects, and other methods that do not serve their original purpose. The government should focus on investing more in better education, increasing the minimum wage, and building assets for working families.

Conclusion:

Overall, the introduction of a wealth tax will do more harm than good, and we should not take such an approach. In general, there are three points. First, the introduction of a wealth tax would lead to a loss of credibility for the government and would be detrimental to the enforcement of subsequent tax laws. Second, the introduction of a wealth tax would instead hurt the economy. Third, the introduction of wealth tax will stimulate capital flight. Fourth, the introduction of wealth tax is not the best way to solve the income imbalance.

The typical approach in modern economics is to design taxes to maximize social welfare, subject to a set of incentive constraints (reflecting the way different people respond to taxes) and government budget constraints. Social welfare is the weighted sum of people’s well-being over their lifetimes, with weights reflecting their aversion to welfare inequality. This framework justifies redistributing income from those who have high welfare over their lifetimes to those who have low welfare over their lifetimes, both in the sense that the extra £1 is worthless to those who already have a lot and in the sense that we care about welfare inequality itself. These benefits of redistribution must be weighed against the dampening effect of taxes on reducing the overall pie; the more we care about inequality the less responsive people are to taxes and the more we want redistribution.

A sudden and blind reduction in the gap between the rich and the poor is not reasonable. And such a price should not be borne by a specific portion of the population who should not be forced to carry the burden of the progress of the entire human society.

References:

Alba, Francisca. Brookings. 2019.

Suzuki, Jeffrey. “Estimating the Economic Impacts of Wealth Taxation in France.” (n.d.).

Wolff, Edward N. “Wealth taxation in the United States.” (2020). New York University

Yadinta, P. A. F., Mulyadi, J., & Suratno. (2018). Kualitas Pelayanan Fiskus , Dimensi Keadilan , Kesadaran Wajib Pajak dan Kepatuhan Wajib Pajak Orang Pribadi. Jurnal Riset Akuntansi Dan Perpajakan JRAP Vol., 5(2), 201–212.

Mei Tan, L., & Chin-Fatt, C. (2000). The Impact of Tax Knowledge on the Perceptions of Tax Fairness and Attitudes Towards Compliance. Asian Review of Accounting, 8(1), 44–58. https://doi.org/10.1108/eb060720

Pichet, Eric (2007). “The Economic Consequences of the French Wealth Tax.” La Revue De Droit Fiscal. n° 14-5