Taxation is the main income of the government. The revenue of the government that is spent on different categories is divided into different Citizens to be known as contributors to society. In the time of social progression, we are lending toward equality and trying to eliminate poverty as much as possible. In the US, paying taxes is a form of government profit. The government will take care of that money and contribute back to society in the development fields such as infrastructures, construction, education, and health care. About 41.5% (OECD, Tax organization) of the government revenues are from income taxes. That is why individual wealth showed a significant impact on government. The main argument is that government should tax wealthy businesses’ corporate contributions to economic usage for social well-being to decrease the gap of wealth between the population. First Tax income from corporates like income from work from wealthy people should be increased to improve education, health, and infrastructure. Second, Taxing more on business and corporate with high-income control tax evasion and reduce loophole of taxation.

In contrast to the arguments, collecting more taxes could be an obstacle to investment and cooperation work because of high taxes in the US. The tax pressure could encourage tax evasion

due to the high amount cooperation are pressured to contribute. Those cooperation deserve the incentive of tax exemption for their economic and social.

First Tax income from corporates like income from work from wealthy people should be increased to improve education, health, and infrastructure.

First, In 2018, the EITC and Child Tax Credit lifted almost 11 million Americans out of poverty (including 5.5 million children) and made almost 18 million less poor (including 6.4 million children). Absent the EITC alone, poverty would be 17 percent higher. When the higher profit cooperates will contribute to the balance of social economics.

Second, some wealthy cooperation should pay more taxes based on their income due to the tax exemptions and the loopholes in the tax system of the government. While companies have the profit and benefit from earning money from people. There are ways for those cooperates to find ways not to pay taxes. ( Kagan, Julia, Investopedia, March 19, 2022) has defined Tax evasion as “Tax evasion occurs when a person or business illegally avoids paying their tax liability, which is a criminal charge subject to penalties and fines.” that is why corporations need to strictly pay taxes and get paid attention. The ones who hold power abuse it the most, just like companies who earn a lot of profit. The more money corporates could earn, the change of tax evasion could happen due to several reasons: the overpowering of the business over the government ruling and law, the tax incentive just to promote the election or regime on tax, and the e-commerce and the digital marketing, people spend and save digitally which is challenging to keep track of the tax collection and income of each individual. For example in the case of the unbalanced power of government and cooperation has led to tax fraud. The case has

raised the area of interest that the big cooperation doesn’t pay enough tax to the developed and developing nations. Big tech companies like Google, Apple, Facebook, and Microsoft. The case of the imbalance of power between companies and government is because of the foreign investment in the third-world countries which focuses on the attraction of resources and investment to develop their countries. There are the taxes investment exemption and the loose legal process to get into countries. That is the reason those companies look at that as the opportunity to commit tax evasion. “Tax havens are the jurisdictions of null or low taxation or as it is said in many countries, non-cooperating jurisdictions.”

The tax exemption or the incentive that has the loopholes in the tax collection which lead the tax fraud. The infamous case by Robert T.Brookeman who is the chief executive director of the big tech companies was charged with tax evasion, wire fraud, and money laundering.

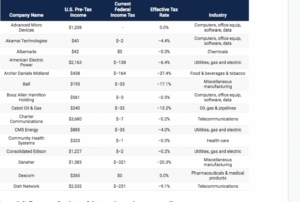

Companies were able to get away from paying taxes based on different factors. Renewable energy promises such as for several companies, including Qurate Retail, Xcel Energy, DTE, and Duke Energy, they could get away with by writing reports to the government about environmental incentives business such as sustainability solutions or producing less carbon emission. In contrast, the report could be fake if the action is not taken as the sustainability as the written in reports. The research and experimentation (R&E) credit can help companies reduce income tax that reduces tax on their income Benefits (figure 1.0). Tax Cuts and Jobs Act as well as the form of companies were allowed to get tax credits and provided those benefits to their employees, it was not always the case, companies could keep their benefits to themselves and exploit their employees by not giving their employees the benefit that they should be provided.

The table above display the amount to percentages of taxes that each company have to pay for their income taxes. However, the percentage itself is not even a positive percentage which means that none of them have to pay the government. This is not the first time that big tech company has taken the advantage of not paying taxes. The Sweeping tax bill in congress in the US that was passed is the result of those main fortune tax exemptions. The bill signed by President Donald J. Trump in 2017 has reduced the corporate tax rate to 21 percent from 35 percent. If Analyzing the policy itself, the most benefit would fall into those wealthy companies which has nothing to do with the social welfare or the contribution to the society’s development.

That occurs when about 500 Fortune companies could eliminate their tax to zero. Take the example of why it is considered a form of inequality if an employee works at a company that paid no taxes to contribute to the social welfare they just earn the profit and keep it but the employees themselves need to get to work and contribute taxes. Employees earn an enormous amount and yet need to pay more taxes than those fortunate companies during the practice of legislation The Sweeping tax bill. The table below shows the estimated gap tax if income is lost due from the top 1% of the wealthy which is equivalent to 163 billion dollars.

On the other side of the perspective, collecting more taxes from wealthy companies also could encourage businesses to commit tax fraud. Since each company is not practically just happened and built on money but also demands hard work and effort that is why tax incentives are put out there for companies in countries to continue doing their jobs. Wealthy firms also help contribute to the economy such as creating jobs, supporting the production country, and working on social cooperation responsibility-the form of the business’s action to contribute to social welfare directly in the name of the company. According to the tax policy center, different ranks are considered rich in the US. The well which is 9% of American households and 0.4% that earn more than 1 million dollars the high income household already pay more taxes than the lower income tax based on the percentage of the table below 3.0. That is why it is unfair for households to even pay more tax than the cooperates themselves.

cooperates shouldn’t pay more taxes because they could use that tax benefit as the incentive program is the best benefit for employees, companies as well as society. The reason for the claim is taking the advantage of the R&E credit incentivizes research activities by reducing tax liabilities for companies that spend money on that research, which lowers the after-tax cost of those activities. The credit is equal to a certain percentage of a business’ qualified research expenses (QREs) above a base amount. Apr 24, 2014.

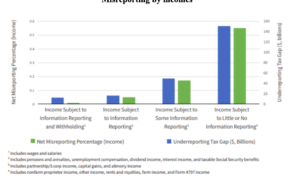

The counterargument, there is the technology that helps tackle tax evasion and tax fraud: So when a company has an incentive in research and development of its products for better quality but also it will help the economy with a wider range of opportunities to improve and research. For example, in Cambodia, the investment tax is low or non-based on the type of business because there is an incentive for the investors to come and cooperate in the country. Companies will see the opportunities tax payment reduction opportunities, faking the profit in those countries that have very low-income taxes so that they don’t need to pay actual money that they were originally supposed to contribute based on the law. Collecting more tax from the tax

pressure cannot be denied, it is one of the factors that cause tax evasion. Besides gaining and collecting revenue, Government should be the emphasis point of collecting and managing taxes. In the data shown by us department of treasury on September, 7th 2021 (figure 3.0). The graph points out that the tax revenues that are collected from American citizens are misinformed and some of them are lost. These data show that we miss some important information from the chart while we were focusing on increasing revenue by providing healthcare, infrastructure, and more social welfare program. The system itself is not fixed, so increasing taxes won’t work if we don’t fix the broken system of the taxes system first.

In conclusion, the main argument is that government should tax wealthy businesses’ corporate contributions to economic usage for social well-being to decrease the gap of wealth between the population. Taxing more on business and corporate with high-income control tax

evasion and reduce loophole of taxation. Tax income from investments like income from work from wealthy people should be increased to improve education, health, and infrastructure.

Collecting more taxes could be an obstacle to investment and cooperation work because of high taxes in the US. The tax pressure could encourage more tax evasion due to the high amount that they need to pay. This cooperation has been working hard, they deserve the incentive of tax exemption to keep their business going. Moreover, the tax revenue lost or wealthy social inequality is not all because the wealthy people pay fewer taxes but because the government system itself cannot control the tax system and make use of their revenue. To summarize the government and corporations should work together to build a society with equality and wellness. While companies should focus on morality and earn money, the government should considerably make the system works and eliminate the error or unlawful act in the tax system. The tax revenue lost or inequality is not all because the wealthy corporates pay fewer taxes but at the same time because the government system itself cannot control the tax system and make use of their revenue. The policy itself should be beneficial to the citizens in general while also keeping the incentive for small and big businesses going. The main concept of taxes collection is to make improvements in society.

Resources: APA

Author, A. A., Author, B. B., & Author, C. C. (Year). Title of article. Title of Periodical, volume number(issue number), pages. https://doi.org/xx.xxx/yyyy

Lastname, F. M. (Year, Month Date). Title of page. Site name. URL

- Enache, Cristina. (February 17, 2021). Sources of Tax Revenue in the United States. Tax Foundation.org Taxfoundation.org

- Office of Public Affairs. (Thursday, September 23, 2021)-Queens Business Owner Pleads Guilty to Tax Fraud. The United State Department of Justice. https://www.justice.gov/opa/pr/queens-business-owner-pleads-guilty-tax-fraud

- Gardner, Matthew, Wamhoff, Steve. (April 2, 2021). 55 Corporations Paid $0 in Federal Taxes on 2020 Profits-Institute of taxation and economic policy. https://itep.org/55-profitable-corporations-zero-corporate-tax/

- OECD. (2017). Technology Tools to Tackle Tax Evasion and Tax Fraud, The cash economy and the sharing economy, pages 21-23. https://www.oecd.org/tax/crime/technology-tools-to-tackle-tax-evasion-and-tax-fraud.pdf

- Office of Public Affairs. (Thursday, October 15, 2020).CEO of Multibillion-dollar Software Company Indicted for Decades. Long Tax Evasion and Wire Fraud Schemes. Department of Justice. https://www.justice.gov/opa/pr/ceo-multibillion-dollar-software-company-indicted-decades-long-tax-evasion-and-wire-fraud

Hanlon, Seth.Hendricks, Galen. (SEP 3, 2021). Addressing Tax System Failings That Favor Billionaires and Corporations. Addressing Tax System Failings That Favor Billionaires and Corporations. The Center for American Progress is an independent