Economic Analysis (CHP)

Introduction

This section looks to bring attention to the economic and financial considerations when talking about Combined Heat and Power at Lafayette College. Initially, it is important to realize where this project resides in a larger macro conversation with regards to natural gas and electricity pricing. Moving forward in the section, we shift gears into discussing the scholarly-driven “spark spread” concept to compare natural gas and electricity prices. Types of costs are identified as those being principal or installation, operation and maintenance, and fuel and electricity procurement. Beyond quantifiable costs or benefits, CHP offers various qualitative benefits like grid independence and reductions in CO2. The bulk of this segment is an engineering economic analysis using largely extrapolated and assumed information of the school’s current state and possible future given researched costs of CHP and pricing of natural gas and electricity. The analysis concludes with a summary of present and annual worth analysis of incremental cash flows, as well as a look into payback periods and what Lafayette College needs to consider moving forward.

Market Factors and Lafayette College

Combined Heat and Power, from an economic perspective, is highly dependent on fuel prices and procurement. Ideally, Lafayette College will prefer to run its CHP on natural gas. When natural gas prices are low, as they are currently, the price of electricity is also low. The 2012 conversation about CHP varied drastically due to the different energy market. Since the advent of hydraulic fracking in the United States, average wholesale natural gas prices dropped significantly as supply skyrocketed.

Before going any further, it is important to understand Lafayette College’s current conditions. As an institution, the College procures fuel for the boilers to heat the school and electricity from the grid to power it. A large amount of our expenses in utilities lies in electricity purchases from Met-Ed, our electrical provider, making this price highly important in our discussion of CHP feasibility. Met-Ed is part of the larger PJM electrical grid, which includes Pennsylvania, New Jersey, and Maryland. To determine Met-Ed’s price, there exists the LMP, which stands for Locational Marginal Price. This price not only takes into consideration the direct cost of the electricity but also includes actual operating condition too (JPM 2016). LMP data is a large factor in decisions around current and future heating and power for Lafayette College (Bruce Feretti, 2016). LMP is also aware of grid strains and efficiencies, which adjust costs appropriately, and for this reason, it is not possible for low-cost generation to be applied throughout the grid system.

Many professors and economists around the United States have tried to understand the economic feasibility of CHP and have gone as far to state that there is a minimum difference between electricity and fuel prices per some unit of energy like therms or mmBTUs that makes CHP beneficial (Mago and Smith, 2014). This minimum difference is known as the “spark spread”, and can be displayed as a ratio of these two prices. For our analysis, we do not consider “spark spread” as an indicator of feasibility because of a lack of definitive information from the College’s electricity usage and bills. Secondly, information on spark spread lacks a definitive ratio that ensures CHP’s competitiveness.

Costs in Combined Heat and Power

What is more valid, in our group’s opinion, is to look at the types of cost. Installation of a CHP system will have upfront or principal costs, in the form of installation or investment in the actual system. Annually, CHP systems have costs for fuel, operation and maintenance and electricity (Kalam, King, Moret, Weerasignhe, 2012). Electricity costs will still exist, yet are greatly reduced, as it is largely advisable to have roughly one third of demand covered from grid power. It is hopeful that these annualized costs are below current electricity and natural gas bills.

A perceived benefit to Combined Heat and Power is a reduction in energy costs from natural gas as overall energy consumption is reduced through the increased efficiency of CHP. In our current state, electricity is coming in from the grid to meet an estimated 30,000 MWh demand at unknown prices. What data we have is merely a prediction based off of financial statements. It is assumed that natural gas costs to meet this demand using a Combined Heat and Power system would be cheaper than the current do nothing perspective.

Other Benefits

Beyond quantitative benefits, Lafayette College will see a reduction in CO2 emissions as part of this reduced energy consumption, which is in line with the mission of the College. Another currently unquantifiable benefit is the independency from the electrical grid. By being able to create power on-site, Lafayette College would be able to separate itself from the dangers of seasonal electricity fluctuations. These fluctuations are impacted by foreign relations and human consumption. (PJM, 2016). In the summer, for example, demand spikes, as more people need to cool their houses, apartments, stores etc. Electricity prices reflect this spike in demand during peak seasons. If everyone cranks on his or her A/Cs, the demand will dramatically increase, and the grid will become strained. To try to accommodate this, supply is shifted and LMP pricing will adjust electricity costs appropriately. Being a part of this larger macro electric system has its downsides as it reacts to seasonal changes in energy usage beyond Lafayette College. A possible benefit, should we choose to keep connection with the grid, is the ability to sell electricity back to the grid during peak loading during summer months (NRDC, 2013). This is especially optimizing for us as a College as our demand drops while students are away on break. Regardless, another benefit tied into grid independence is the ability to be functional during grid outages. This assumes full production of heat and power on-site, something that, as mentioned before, is not entirely advisable. However, as an institution, running classes during blackouts can potentially provide educational benefits that lie outside a dollar value.

Cash Flow Analysis

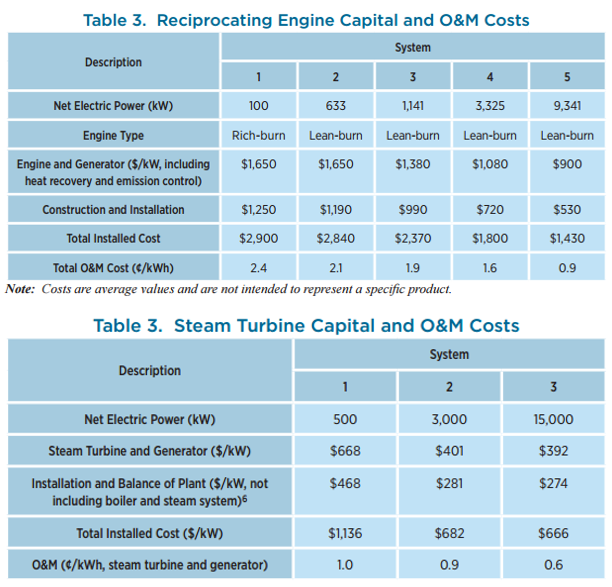

Getting into the more technical side of the economic analysis, the best way to determine feasibility is to compare cash flows of a CHP reciprocating engine with capacity to meet Lafayette College’s heat and power demand, to the do nothing alternative of today. As alluded to earlier, natural gas has proven to be an unpredictable fuel source that highly influences CHP and electricity prices. For this reason, we do not find it beneficial to remain content with Lafayette’s feasibility study from 2012, as their data assumes a 2012 cost for electricity and natural gas. Instead, the US Department of Energy provided a catalogue in 2016 of over four major CHP technologies, denoting capital and operating/maintenance costs (DOE, 2016). This data provides a basis for possible principal and O&M expenses for natural gas and steam cogeneration systems.

Using the below Table 1, as provided by the US Department of Energy in July of 2016, we have extrapolated the total plant cost for a reciprocating engine with a nominal capacity of 4000 kW to be roughly $1700/kW and a steam turbine with equal capacity to be roughly $800/kW. As mentioned in the technical analysis, we already have steam turbines on site. Therefore, the more applicable information is that of the reciprocating engine. Again, it is important to stress that these values are estimates, and do not stand as fact yet provide us with a good jumping off point for our economic examination.

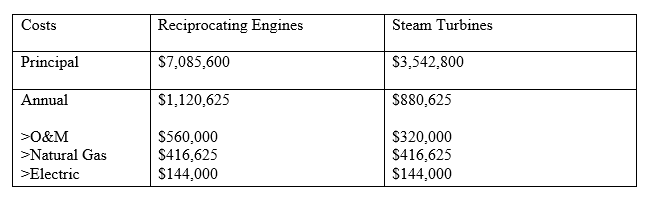

Principal Costs

Likewise, it is important to note that these are average values, not specific to location. Adjusting this project for the Lehigh Valley, we looked at RS Means’ localization index to create the most accurate investment price for a 4000 kW reciprocating engine or steam turbine at Lafayette College. This value is 1.042 (RS Means, 2016). By adjusting this initial construction cost for location, and multiplying by the net electric power demand of 4000 kW, we estimate that a reciprocating engine system will have a principal cost $7,085,600.

Annual Costs

Mentioned earlier in this economic section, operating and maintenance costs exist and must be accounted for in our analysis. Again, basing our cost estimate off of the US Department of Energy’s CHP report with 2016 estimates, we looked at O&M costs per kWh and thought $0.014/kWh to be an appropriate price for reciprocating given the hypothetical capacity. When multiplying these terms by the 40,000,000 kW of natural gas procured, total O&M costs for reciprocating become $560,000. It should be noted that the quantity of natural gas procured is selected with the assumption that these combined heat and power systems function at a conservative 60%.

Natural gas prices were determined by looking at UGI Dec 1, 2015 data on current natural gas prices per mcf, converting to mmBTU, and multiplying it by an approximate 40000 MWh. Paying close attention to units when converting mcf to mmBTU followed by mmBTU to MWh, the following table is produced. This supply makes up a bit more than two thirds of the total MWh of Lafayette College in 2016 of, again an approximate, 30000 MWh. As stated previously, 40000 MWh is used as total procurement of natural gas. The other third is electricity procured from the grid as stated earlier. This other third carries with it a cost derived from JPM’s LMP pricing from Met-Ed. An estimated 8000 MWh multiplies the dollar value per MWh set by JPM. Table 2 below has been created above to simplify the associated costs of reciprocating engines and steam turbines.

Assumptions In Analysis

Now we get into the assumptions behind this project’s feasibility. As mentioned at the start of this section, natural gas prices are critical concerns for this technology’s feasibility. If we are able to meet our energy demand on-site through natural gas at an annual price more attractive than the current model of electricity purchased from Met-Ed, and at a difference large enough to make up the capital cost over its life time, this technology will be economically feasible. To do this, however, we need to make assumptions about natural gas prices at procurement, and inflation rates over the next 20 years. This is something that even the world’s best investment banks struggle to do. For this project, we make the risky assumption that natural gas prices and interest rates will remain constant. Thirdly, due to the current lack of 2016 electricity and natural gas cost and usage data at Lafayette College, we are forced to work with a potentially dangerous extrapolation and assumption theory of this information due to Z&F 2012 values compared to Lafayette College’s Financial Statements from 2012, 2015, and 2016 (Lafayette College, 2016).

Without an accurate utility bill from the College, our group is left to cross-examine the data from the Z&F 2012 study for electricity and natural gas expenses for the College, we compared this to the Financial Statements from that year and found that electricity made up approximately 70% of the category labeled “utilities” (Lafayette College, 2013). Using this extrapolated data, we went to Lafayette College’s Financial Statements for 2015-2016 and approximated 70% of the “Utilities O&M” section. The resulting conclusion is that Lafayette College spends about $ 2,889,453.78 yearly for electricity purchases and steam production under our current system. This quantification is used in calculations throughout the remainder of this report, and therefore carries much weight.

Present and Annual Worth Calculations

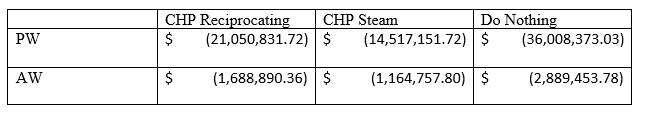

Running engineering economic calculations for the three alternatives with a minimal attractive rate of return of 5% per year and a life of 20 years, the following Table 3 is produced.

Looking at the incremental cash flows from a payback period analysis, setting present worth equal to zero, we find that the reciprocating engine CHP has an approximate payback period of 4.1 years and the steam turbine technology to have a brief 1.8 years. This distinction can be largely attributed to the steam turbine’s upfront cost being roughly half that of the reciprocating engine, and annual expenditures from operations and maintenance per KWh being a fraction of that for reciprocating engines too. Either way, short payback periods are very important to Lafayette College and make this project economically feasible.

Decisions

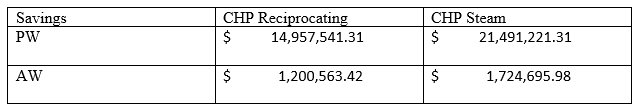

Based off of these calculations alone, the steam turbine CHP technology is the most advantageous to Lafayette College as the cost is the least negative presently and over its life cycle. However, due to the interest of increased reliability and the fact that we already have a steam turbine, purchasing a reciprocating engine becomes the next step. In an attempt to compare these CHP two systems to the do nothing alternative, incremental cash flows can be created where the annual cost comes in the form of savings. A cost saving from these technologies is a cash inflow. In other words, since calculated annual costs for O&M and heat/power production is reduced through CHP, these act as savings or cash Lafayette College now “has”. Using the same MARR and time period, incremental savings presently and annually are calculated in Table 4 below.

If Lafayette were prompted with the need to adopt combined heat and power technology, assuming they perform comparably in terms of efficiency as the calculations have assumed, reciprocating engine would be the appropriate alternative. The table above is showing what Lafayette College would experience shifting over to the new technology, as annual costs will drop dramatically, resulting in large savings or fictitious cash inflows. These calculations are all accessible on the excel document on the website, which can be adjusted to yield different results depending on input: CHP Spreadsheet

CHP Going Forward

Now that this economic data has been compiled, Lafayette College is again faced with the same questions from 2012. This project is heavily dependent on forecasting, and therefore large amounts of uncertainty. A project with a life of 20 years like this one is tough to fully understand financially as there is a lot of time for market changes. Will natural gas prices spike over the next 20 years due to reduced supply, thus influencing natural gas procurement and electricity grid production? What role will the government have in incentivizing particular fuel sources over others? How will inflation rates, which are dependent on how the Federal Reserve buys and sells federal securities, influence the minimal attractive rate of return for this type of project (Investopedia 2016)? These are all questions, which factor into the overall feeling of uneasiness and uncertainty, which could be an explanation for this technology’s denial years ago.