US Policies

Federal and state policy in the United States influences the usage of wind turbines and wind energy. The US policy addresses three categories: Research and Development Organizations, Commercial/Residential Generators, and Manufacturers and Producers. The policies provide incentives for wind turbine use, require production and installation of wind turbines, or require production of electricity from wind. Furthermore, the policies have the goals to facilitate the appropriate location of wind turbines. The most important policy for the United States is the Wind Production Tax Credit [3].

Production Tax Credit (PTC)

The Production Tax Credit (PTC) was a part of the Energy Policy Act of 1992 and was intended for wind and bioenergy resources. The purpose of the Production Tax Credit is to support renewable energy with the intent to raise levels of installation, research, and development. The tax credit was created to promote the benefits of renewable energy. Besides wind energy, the PTC also covers other renewable energies like closed loop biomass, geothermal power,hydro-power, landfill gas, and municipal solid waste. To promote these technologies and the benefits, the credit provides a 2.2 cent per kilowatt-hour benefit for the first ten years of a facility’s operation [1]. This makes the technology more economically feasible and more likely to be embraced by the public and corporate industry.

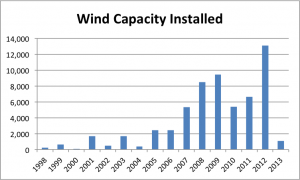

The original credits were enacted in 1992 and then lapsed in 1999. They were reenacted in 2000 and lapsed in 2001. This pattern continued each couple of years until 2010, when it was extended until 2012. The credits have provided the renewable industry with jobs, and a path to enter the market. When the tax credits are enacted, the installation rate is much higher than without the credits. This can be seen in the graph below [1,2].

As seen in the Wind Capacity Installed graph, when the tax credits lapse or are stalled for a period of time, the installations that year decrease. This is most significantly seen from 2012 to 2013. The tax credit allowed for many wind turbines to be installed in 2012, and when the tax credit wasn’t going to be renewed the 2013 wind turbine installation decreased to 1/10 of the previous year. This shows that until the wind industry is more developed it will have a strong dependence on the PTC.

1. “Energy.gov.” Renewable Electricity Production Tax Credit (PTC). N.p., n.d. Web. 04 May 2014.

2. “Federal Production Tax Credit for Wind Energy.” Federal Production Tax Credit for Wind Energy. N.p., n.d. Web. 11 Apr. 2014.

3. “Production Tax Credit for Renewable Energy.” Union of Concerned Scientists. N.p., n.d. Web. 13 Apr. 2014.

Primary Author: Ryan Younis

Primary Editor: Stephen Schappert