In the United States, the management of geothermal electricity plants and the development of new geothermal resources are governed at both the federal and state level.

Federal

The federal government provides several different tax credits and research grants for developing and maintaining geothermal power plants.

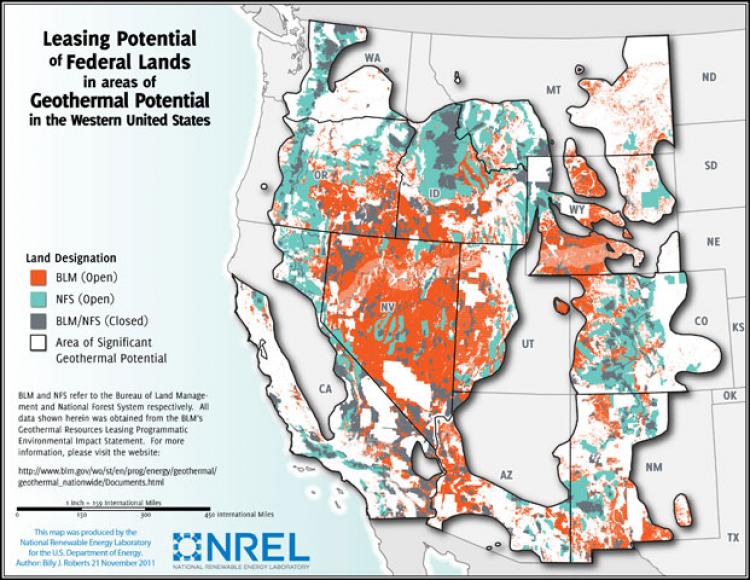

The John Rishel Geothermal Leasing Amendments, passed as part of the 2005 energy bill, lay out the policy for leasing federal land for geothermal development. As approximately 90% of the United States geothermal resource is located on government property, it is a crucial piece of legislature. Leases on federal land typically last for 10 years with an option to extend for an additional 10. The developer pays from $1.00 to $5.00 per acre, as well as a a 1% to 5% royalty on all electricity sold. The full text of the amendments can be found in the U.S. Code at the Office of the Law Revision Council website.

Geothermal development often qualifies for the Business Energy Investment Tax Credit, outlined in the Energy Improvement and Extension Act of 2008. It provides a credit equal to 10% of generation expenses with no maximum amount in place. The credit applies only to the generation itself, not any transmission costs. A geothermal project can also qualify for

the Renewable Electricity Production Tax Credit. This is a per-kilowatt-hour tax credit for electricity generated by plants established before Dec 31, 2013. The credit pays out a flat rate of 2.3¢/kWh for the first ten years of operation.

The grandfather of geothermal legislation is The Geothermal Research Development and Demonstration Act, passed by Congress in 1974. The act is no longer as relevant as it once was, but it laid the groundwork for many of the pro-geothermal laws today. The act provided investment security for private and public projects to develop new technologies for exploiting geothermal resources. Also included are loan guarantees and education support for geothermal related programs. The full text of the act can be found in Title 30, Chapter 24, Sections 1101 et seq of the U.S. Code at the Office of the Law Revision Council website.

The Advanced Geothermal Energy Research and Development Act of 2007, which was part of The Energy Independence and Security Act of 2007, serves as a successor to the 1974 act. It outlines support for research and development of geothermal technologies, including the location of new resources and the exploitation of resources located at fossil fuel drilling sites. Included in the act are provisions for mitigating or preventing possible adverse environmental impacts involved in geothermal resource use. The entire text of the act can be found here.

State

The state regulations and incentives for geothermal electricity development are as diverse as the states themselves. One regulation type that is common to 33 of the states is the Renewable Portfolio Standards (RPS). These standards require utility companies to have a growing percentage of renewable power generation after a certain year. These percentages vary from just 10% to over 40% by 2030.

The financial incentives offered by a state for geothermal electricity development are too numerous to name, but a complete list can be found at the Database of State Incentives for Renewables & Efficiency website. A map of states that have financial incentives is shown below. Currently, 43 U.S. states and Puerto Rico offer some sort of benefit, whether it be tax exemptions, start-up grants, or development loans.

California has an interesting approach to geothermal incentives. Through the Geothermal Grant and Loan Program, the state provides aid to new developments of geothermal resources. The money for the grants comes from royalty and lease payments made by existing geothermal developers operating on federal land. This results in a feedback loop of increasing geothermal exploitation and grant money to do so. As of 2013, California was producing 2,703 MW of energy from geothermal plants.

Primary Author: Andrew Leuschner

Edited by: Jessica Ross

Citations

30 U.S. Code Chapter 24 – GEOTHERMAL ENERGY RESEARCH, DEVELOPMENT, AND DEMONSTRATION. (n.d.). LII / Legal Information Institute. Retrieved May 3, 2014, from http://www.law.cornell.edu/uscode/text/30/chapter-24?qt-us_code_tabs=1#qt-us_code_tabs

Energy.gov. (n.d.). A History of Geothermal Energy in America. Retrieved May 2, 2014, from http://energy.gov/eere/geothermal/history-geothermal-energy-america

Incentives/Policies for Renewables & Efficiency. (n.d.). . Retrieved May 5, 2014, from http://www.dsireusa.org/incentives/index.cfm?EE=1&RE=1&SPV=0&ST=0&implementingsector=S&technology=Geothermal_electric&sh=1

United States Code. (n.d.). OLRC Home. Retrieved May 3, 2014, from http://uscode.house.gov/browse/prelim@title30/chapter23&edition=prelim