Economic Analysis (GK)

There are a few different goals that the economic analysis should achieve for this project. The first is to detail the up-front costs to the college for a set of market alternatives to introduce regenerative fitness machines to Kirby Sports Center. It will also review which avenues are possible for finding funding for this type of project and recommending a plan of action on the best option for the college to keep this project running beyond its initial installation. The economic analysis will also look at a present worth analysis of the lifespan of a possible option, and how these machines could eventually pay for themselves given a reasonable use case scenario. Finally it will relate this information back to the project as a whole, showing its relationship to the project and how it affects our intended goal.

Upfront Costs

One option for implementing this type of system in Kirby Sports Center is to use the Green Revolution UpCycle Ecocharger. This is a Do-It-Yourself solution and would only be applicable to workout bikes in the gym. the UpCycle components replace the back wheel of a bicycle, or attach to the flywheel on a spinning bike. There is a 600 watt inverter as well that converts the electricity to a usable output to the house. Interestingly Chevrolet used this system in a display at the 2015 Pan-Am games in Toronto. They did extensive testing and proved that it could be used for extensive periods of time in high heat, which should give some comfort that this is durable enough for daily use in Kirby Fitness Center (Boesel, July 13) . These Kits cost $1,150 to buy, and this includes everything for it to be set up correctly. However with this solution there will be outside wires, and it is not a cohesive system that has been rated for commercial use.

Another option we have explored is the solutions from Re-Rev. They are a consulting company that will retrofit existing equipment and suggest new equipment to use in this system. This would allow Kirby Fitness Center to be more flexible in the types of machines they included in the system. Unfortunately they want a considerable amount of information from the customer before installing a system, which makes it tough to recommend as a viable economic solution. Additionally, the company itself is based in Florida, with no affiliates in the areas nearby area which means any maintenance would either have to be completed by Kirby Fitness Center staff, or would have to wait until the company could come do the maintenance themselves.

Finally there is a commercial option through the Green MicroGym. They sell ellipticals, reclining bikes and spin bikes made by SportsArt that include the inverter in the systems themselves. These machines are on the premium end of the aerobic fitness machines, but they are not unreasonably out of price range. They offer premium quality machines that existing users are familiar with and come with the company’s warranties, as well as with the latest updates and designs from SportsArt.

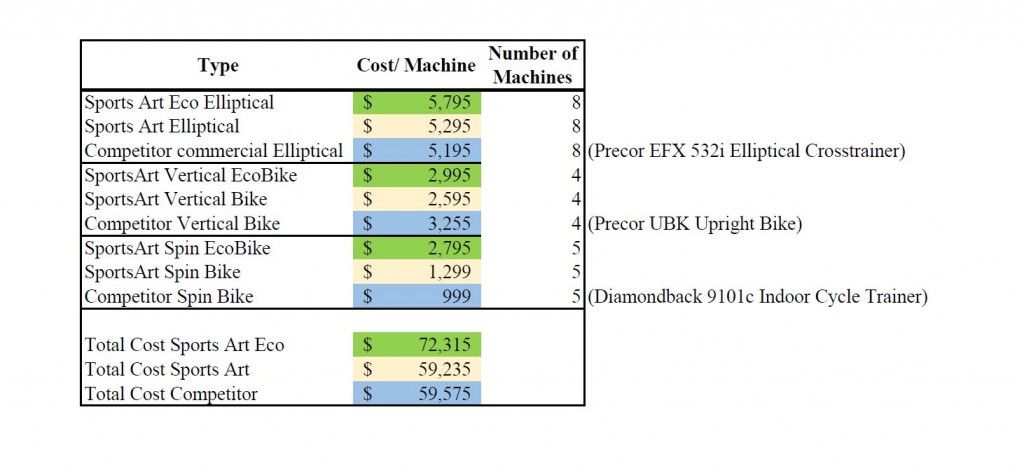

Based on the availability, ease of use and cost, we believe that the SportsArt option is the best option going forward for the gym to implement a system for regeneration in the Kirby Fitness Center. These are commercially ready machines that have been tested in many gyms already. The machines are reasonably priced, and work exactly like the machines they would be replacing, as the college replaces machines. finally they come from a large enough supplier that there will be ample support, and the ability to buy more if the initial project is effective (Boesel, December 5). Figure 1: Cost Estimates is a cost breakdown of the SportsArt Eco line vs. their regular line, as well as a comparison of both to a competitor’s machines of similar quality based on price.

Analysis of Cost Recuperation

One of the primary goals of Lafayette College when selecting sustainability projects is for them to be economically sustainable as well. That is, they will cover the cost of installation and operation over the course of their expected lifetime. When determining whether or not this project will do this, we have to look at a couple of different factors. First, using Figure 1 we determine that there is about a $12,700 premium for fully outfitting the gym with regenerative fitness machines. We will use this as the price to cover in terms of installation cost because the regular cost for replacing the aerobic machines is already factored into the budget for the gym.

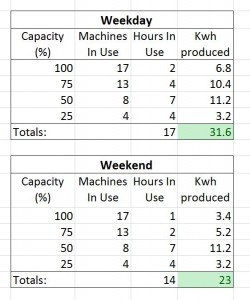

Based on literature from the Green MicroGym we estimate that the average user will produce about 200 watts when using the equipment. For this analysis we will assume that we are using all suggested 17 machines. We have to estimate how often and how many of the machines are being used during the day. Based on observations there are times each day where every single machine will be in use, and there are other times during the day where there will be only a percentage of machines used. Figure 2 describes the distribution of machines in use, and hours of that many machines in use. We end up with about 32 Kilowatt-Hours produced during the average weekday and 23 Kilowatt-Hours during weekends.

According to George Xiques, Assistant Director and Sustainability Planning for Lafayette College, Lafayette pays 0.08 cents per Kwh of electricity they use (G. Xiques, personal communication, December 1, 2015) . Multiply this by the projected production and we get approximately $2.50 per weekday and $3.68 per weekend (Saturday and Sunday). There are 140 weekdays in our school year and 28 weekends, so the estimated total payback for weekdays during the semester is approximately $457. If we divide this by the $12,700 premium we said we need to cover then it would take about 28 years for Lafayette to see a return on its investment. This only includes information pulled on times when students are in session as this is when the machines will be in regular use.

Based on these numbers, this project will not currently be able to cover even its capital cost in a reasonable amount of time. This is a major hurdle for Lafayette and will have to be taken into consideration as the college decides on different alternatives in energy generation experimentation and production for the college.

Capital Budget and Grant Considerations

July is the start of the college’s fiscal year. October is when we would submit an expenditure request to the college. We have looked through the college’s commitment to sustainability and have found sections that say that they will be financially committed to the growth of the cause as well as physical solutions to reduce energy, water and fuel usage on the college campus. Lafayette College, under the Climate Action Plan (November 2011) has pledged to spend $400,000 per year for ten years to reduce campus emissions by 20%. This project could fall under this grant as an educational tool and as a way the campus is reducing its electricity usage.

From the project prospective, this could actually fall under a couple of different budgets. The capital request is the most broad area of budgeting that the college could consider this project under. We could also try and fit it in through the Sports Center Budget, under the premise that Kirby Sports Center has a budget to periodically replace and renew its aerobic athletic machines. We would have to prove that the extra expense incurred with buying upscale machines is offset by the educational opportunity and the small amount of energy savings that can be achieved through using these athetic machines.

Present Worth Analysis

| Economic Dimension | Monetary Estimate | |

| 1 | Cost of Machines | $72,315 |

| 2 | Estimated Cost of Original Machines | $50,000 |

| 3 | Maintenance | n/a |

| 4 | Estimated Premium on Using SportsArt Eco Machines (Fig.1) | $12,740 |

| 5 | Energy Savings | $457/Year |

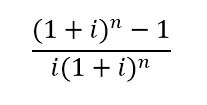

A present worth (PW) analysis will allow us to look at the actual cost to the college over a predetermined number of years, given the cash flows that we know we have. It will give a more accurate idea of how much this project will cost Lafayette College. The present value will be less than the amount of the future value because we must take the interest rate into account (Blank, L., & Tarquin, A., 2012, p. 129). For this project we are using an interest rate of 3% because that is the national average at this time. (Todays Interest Rates, December 2015).

There are two cash flows in this model: that of the initial cost and that of the annual amount that the college will save because the energy generation. For the initial cost we will use the premium of using SportsArt Eco machines over a competitor’s option, which is $12,740. This allows us to see whether or not we have a positive present worth, meaning that the SportsArt Eco machines cost less in the long run because of their ability to generate energy for Lafayette College. The annual cash flow will be $457 per year based off of earlier calculations about the efficiency and use of the machines. The life of the project will be ten years. This is extremely optimistic, considering the warranty of parts is five years, although the frame and display have a lifetime warranty. Our equation then will look like this:

Our annual cash flow needs to be turned into a present worth, so we use the Uniform Series Present Worth Formula:

Combining these we get the formula for our projects Present Worth:

After running the numbers, PW is equal to – $8,841.70. This is how much it would cost the College in present dollars, assuming no tax breaks for this small amount of electricity generated, or any operating and maintenance costs incurred with the machines over a ten year span. What this number means is that it would cost Lafayette almost $9,000 more to implement these machines than the current alternative.

The solution described produces a respectable amount of energy. The numbers indicate that the college can generate at least $450 worth of electricity per year with 100% implementation. Unfortunately they also fail to generate enough energy to recoup the cost of implementation. It would take our project tens of years to repay the premium of the machines, which is longer than the projected life of the product itself. Economically, introducing regenerative aerobic machines into Kirby Fitness Center is feasible. It is well within the confines of acceptable amounts to spend based on clear goals and objectives that correctly align with current Lafayette College sustainability initiatives. However, fiscally this project is tough to sell at face value to the College Administration simply for the fact that there is not enough recuperation of costs to sustain the capital expense or the operational cost of running the gym.

Next Page: Conclusion

Previous Page: Technical Analysis

Unit Costs References:

| Sports Art Eco Line: | The Green MicroGym |

| Sports Art Regular Line: | SportsArt |

| Competitor Elliptical: | Precor EFX 532i Elliptical |

| Competitor Vertical Bike | Precor Upright Bike |

| Competitor Spin Bike | Diamondback 910ic Indoor Cycle |